Greetings,

United States:

The FOMC minutes revealed an even more hawkish Federal Reserve than the markets were expecting.

• Inflation concerns:

Participants remarked that inflation readings had been higher and were more persistent and widespread than previously anticipated. Some participants noted that trimmed mean measures of inflation had reached decade-high levels and that the percentage of product categories with substantial price increases continued to climb.

• Faster rate hikes:

Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

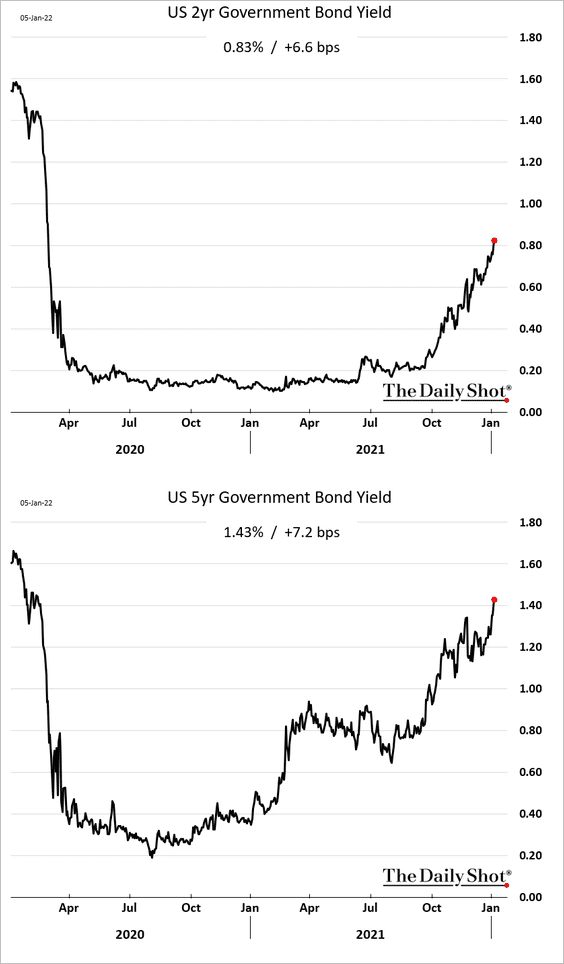

Bonds around the world sold off in response to the hawkish FOMC minutes.

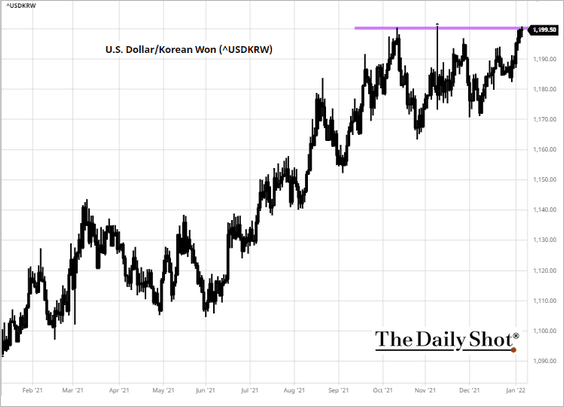

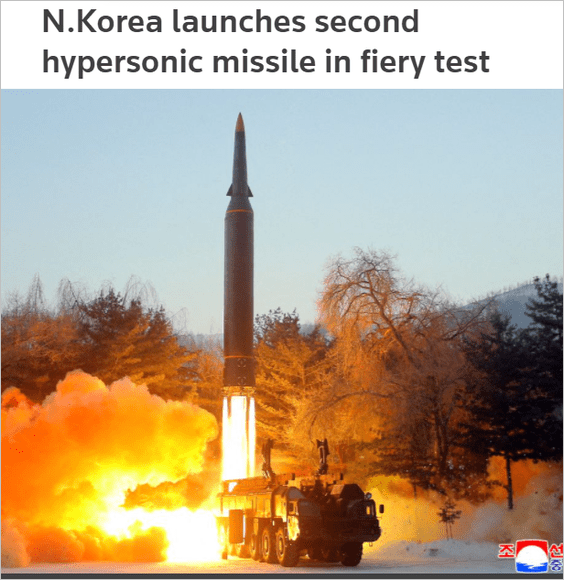

Asia-Pacific: USD/KRW is testing resistance as the won weakens due to the hawkish FOMC minutes and North Korea’s latest missile test.

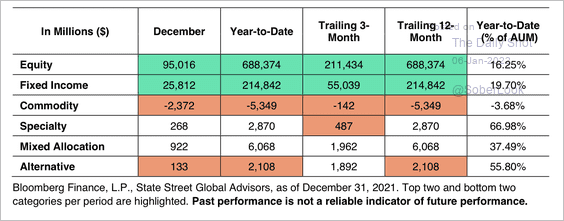

Commodities: Commodity ETFs saw outflows last year, dragged lower by gold exposures.

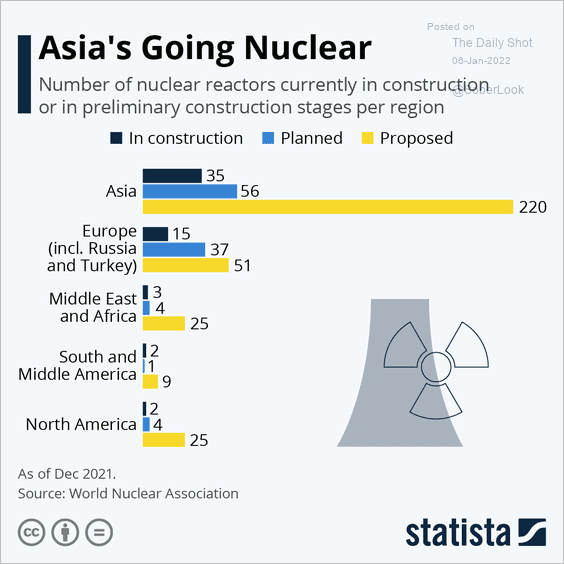

Energy: Asia is embracing nuclear power.

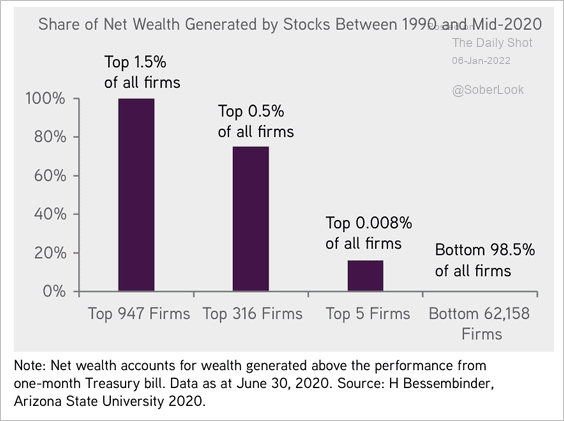

Global Developments: Just 1.5% of all stocks have generated net wealth in global markets over the past 30 years.

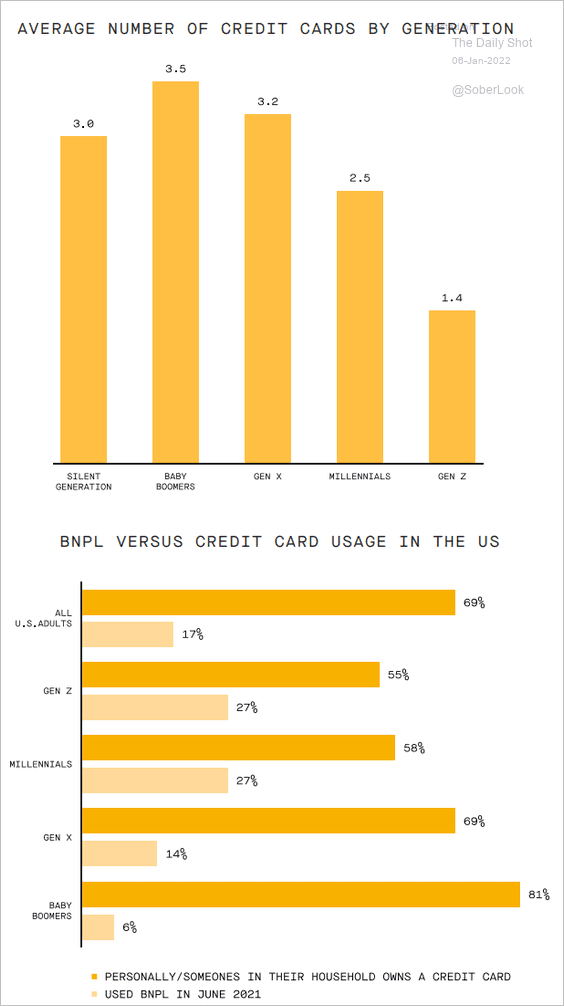

Food for Thought: Credit cards vs. BNPL (buy now pay later):

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com