Greetings,

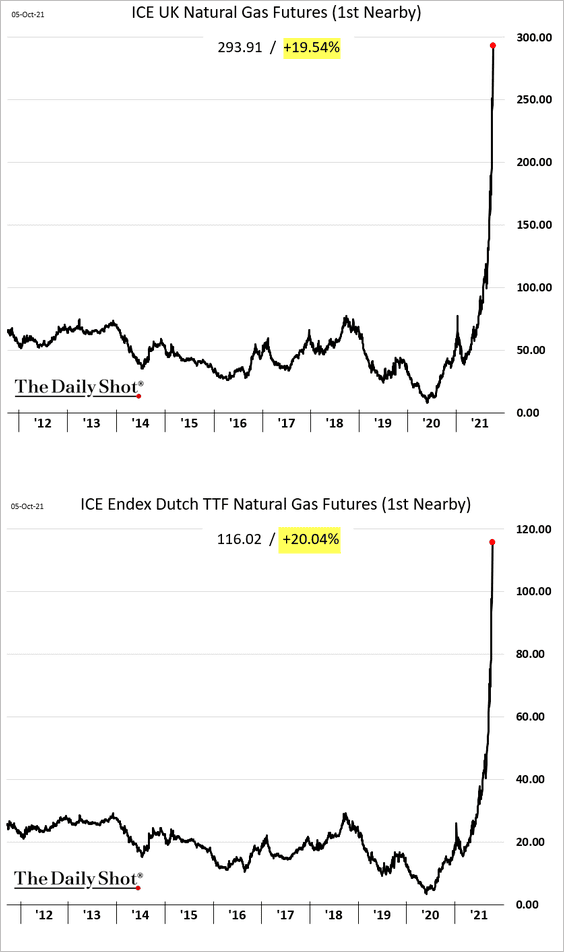

Energy: European energy prices have gone vertical. These unprecedented market moves will scar European and global economies by squeezing corporate margins and ultimately cutting into households’ disposable incomes and sentiment.

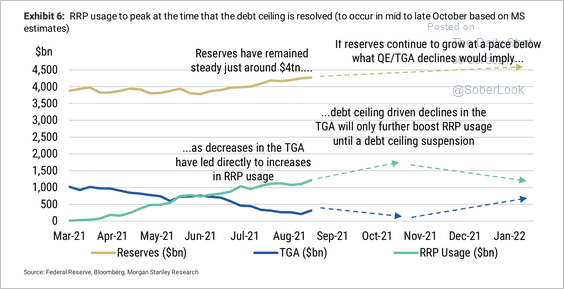

Rates: Morgan Stanley expects the Fed’s RRP (reverse repo) program usage to peak in size when the debt ceiling is resolved (when the Treasury general account will reach its lowest point before getting rebuilt).

The first leveraged loan tied to SOFR (LIBOR replacement) should boost confidence in the transition.

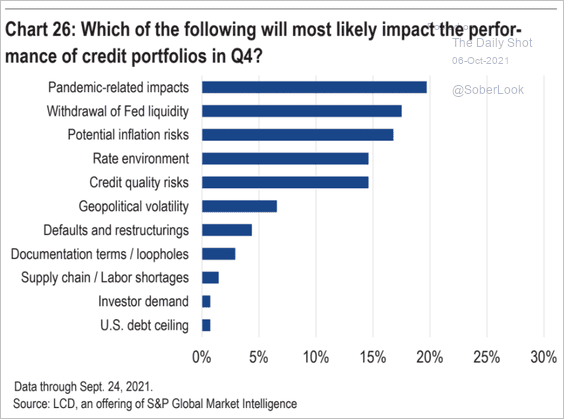

Credit: Which of the following factors will most likely impact credit portfolios?

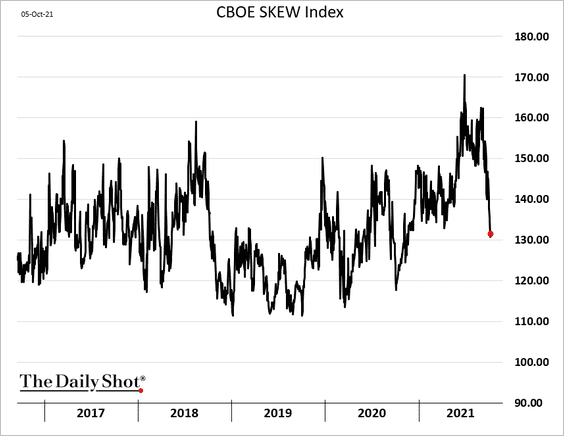

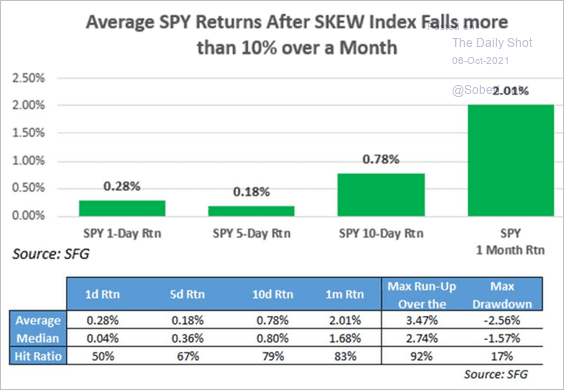

Equities: What does the decline in option skew …

… mean for stocks?

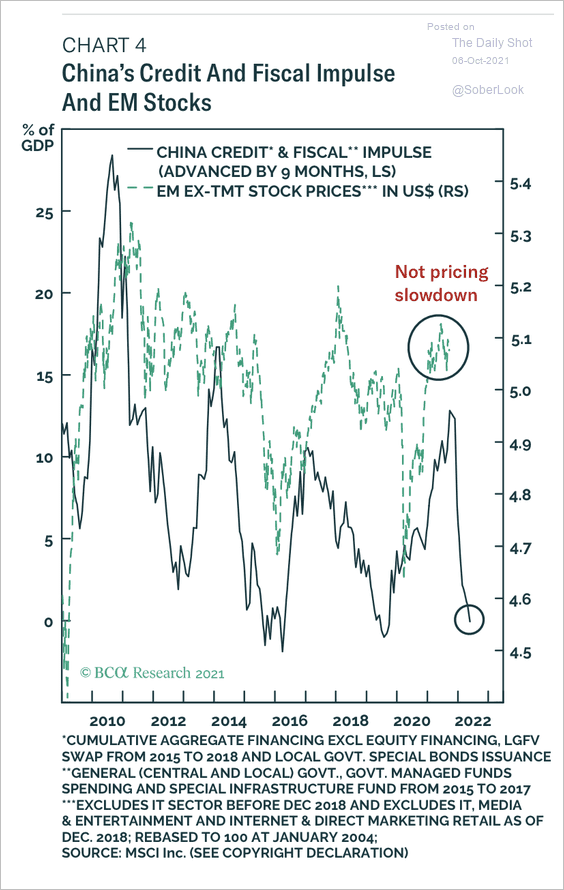

Emerging Markets: It appears that EM stocks have not fully priced in a slowdown in China.

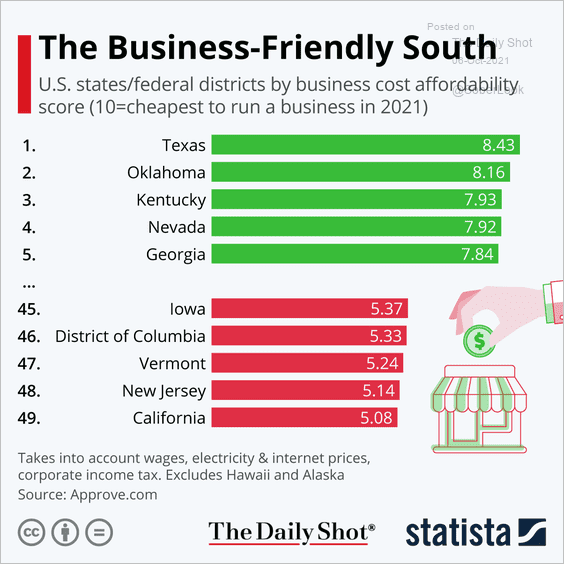

Food for Thought: States with the highest and lowest business cost affordability:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com