Greetings,

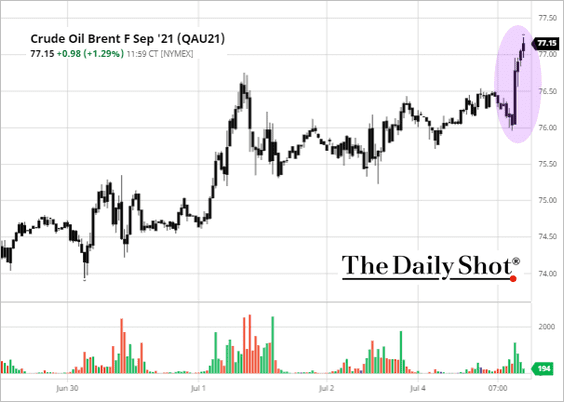

Energy: The OPEC+ production increase is off the table for now as the impasse continues.

Oil prices jumped.

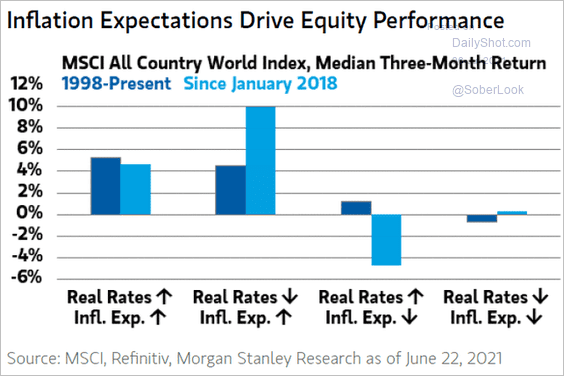

Equities: Higher inflation expectations tend to be good for stock performance.

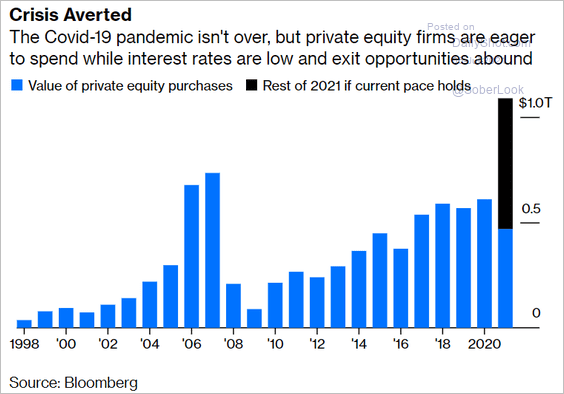

Alternatives: PE acquisitions are surging this year. Given frothy valuations, the latest vintages are likely to underperform.

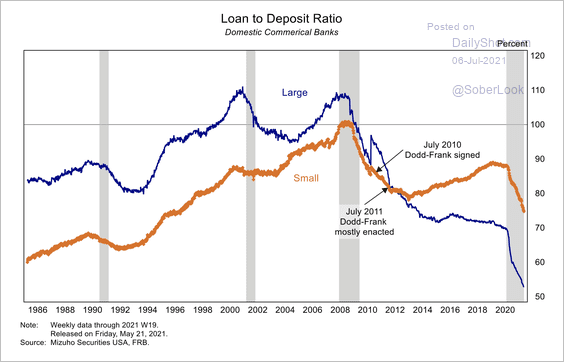

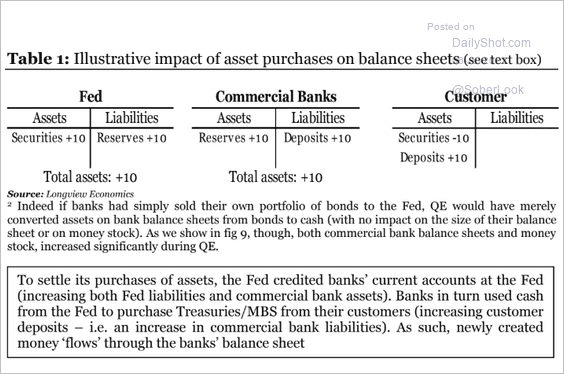

Credit: As discussed previously, the loan-to-deposit ratio continues to decline, especially for large banks. The recent declines have been driven by the Fed’s QE, which sharply boosted deposits.

By the way, the table below illustrates how QE increases deposits in the banking system.

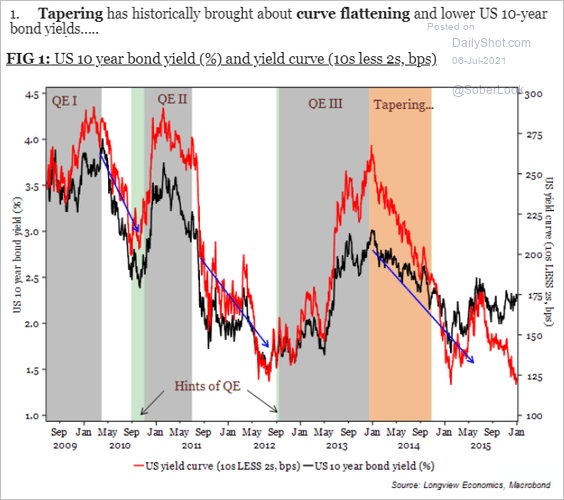

Rates: QE tapering tends to flatten the yield curve.

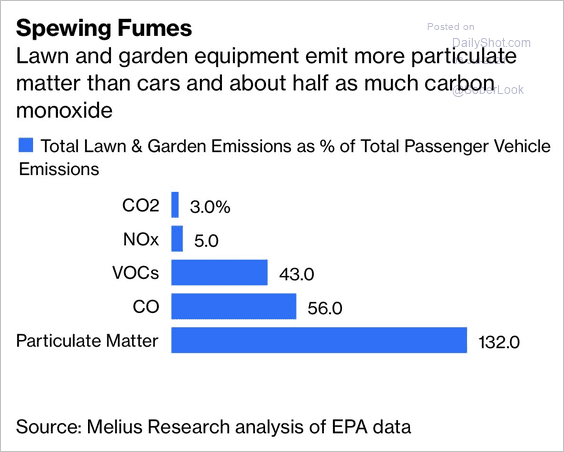

Food for Thought: Lawn and garden equipment emissions:

Edited by Richard Holmes

Contact the Daily Shot Editor: Editor@DailyShotLetter.com