Chart of the Day

The Fed announced yesterday that it will now start to taper its asset purchases, but only pre-announced what it intends to do for the next couple of months. At the current pace of tapering announced for the rest of the year, in which it has cut combined purchases of government bonds and mortgage backed securities by $15bn per month, the Fed would finish the programs in a little less than six months. That will increase talk that the Fed will cut rates in the second half of 2022, which is already what markets are pricing in. Nevertheless, the coming quarters will help determine whether the Fed’s purchases truly were a major factor in supporting markets. Lately, it has been increasing the size of its balance sheet gradually, though not be anywhere near as much as the ECB has been doing.

Macro

Ahead of the US non-farm payrolls report on Friday, the ADP employment report showed a stronger-than-expected increase of 568,000.

A weighted average of the ISM surveys rose to 68.0 in October. That is a good sign for GDP growth, though the surveys have been too positive lately.

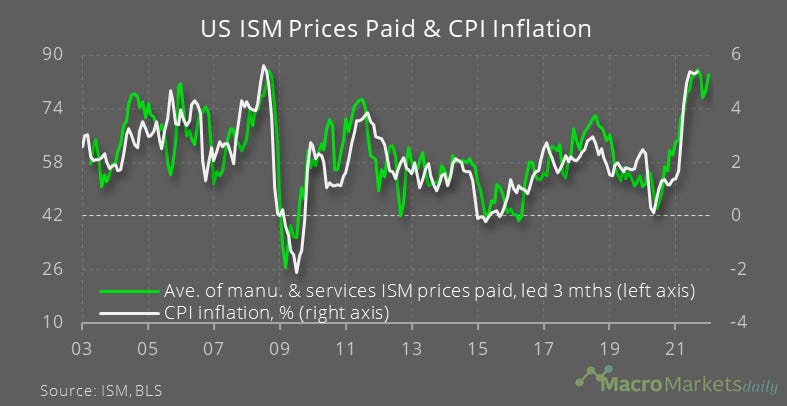

An average of the ISM prices paid indices rose in October, almost back to the recent peak.

UK house price inflation according to Nationwide was little changed at 9.9% in October. Realtors’ expectations point to a slowdown ahead.

Markets

US yields generally rose yesterday following the Fed announcement. The US 10-year yield has risen by 5 bp in the past week, the 5-year has risen by 4 bp and the 30-year has risen by 6 bp.

Despite those moves, the USD generally depreciated – that’s a pretty good sign for global markets.

The weekly EIA report showed crude inventories rose by 3.3 mn barrels last week and are now 2.5% lower than their average at this time of year over 2017-19.

The weekly EIA report showed that US crude production rose by 0.2 mn barrels last week.

With output rising and inventories also up, WTI fell sharply yesterday, to $80.9. Over the past week, it is down by 2.2%.

Like what you see? Please forward this email to your friends and colleagues, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily