Greetings,

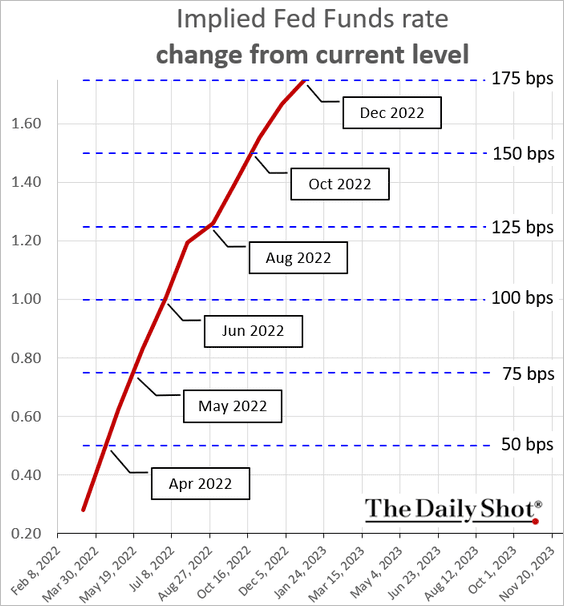

United States: Seven Fed rate hikes for 2022 are now fully priced in. The chart below shows the futures market’s expectations for rate increases (in addition to the 25 bps hike this month).

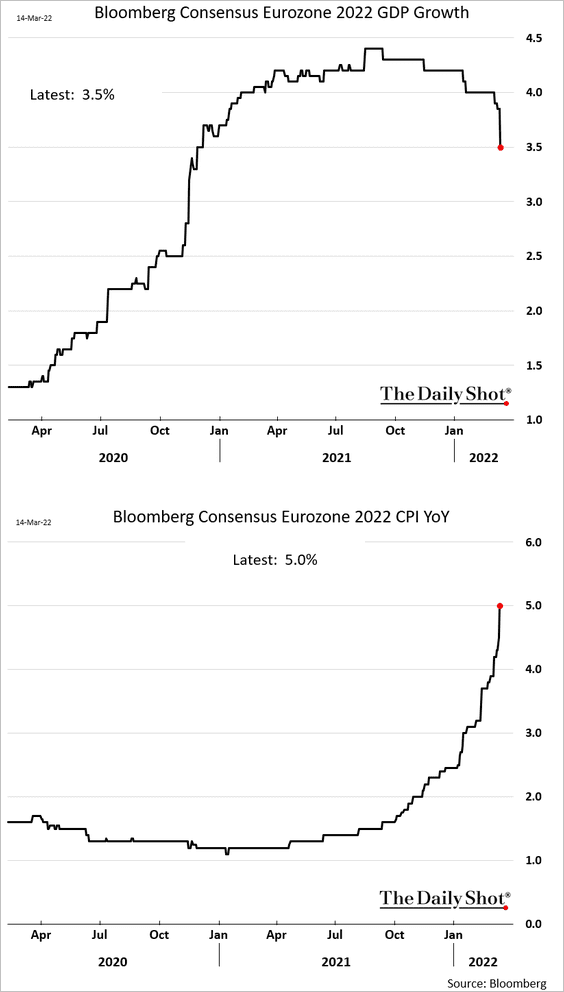

Eurozone: Economists have sharply reduced their GDP forecasts while bumping up inflation projections – a stagflationary trend.

As a result, fund managers are very bearish Eurozone shares.

China: Investors worry that China’s firms may get caught up in the anti-Russia sanctions. The index of US-traded Chinese shares is down 75% from the peak.

Commodities: Fund managers now see the commodities bet as the most crowded trade.

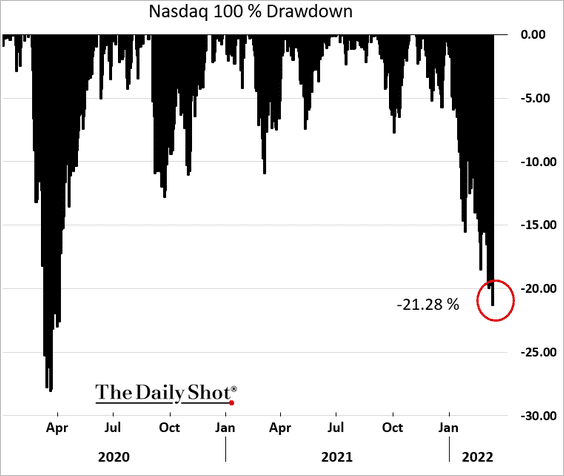

Equities: The Nasdaq 100 is in bear-market territory.

Food for Thought: Military equipment losses after Russia’s Invasion:

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com