Chart of the Day

The 5-year breakeven inflation rate (i.e. the difference between the nominal and real 5-year bond yield) rose to 2.87% yesterday, the highest since early 2005. One key difference now though is that the 5-year/5-year rate is still relatively low at 2.4%, which is less than it was for much of the 2010 to 2014 period. The Fed will take some comfort from this as a sign that investors still believe the period of high inflation will be transitory, even if that “transitory” turns out to be a lot longer than the Fed first thought as supply disruptions continue to be felt.

Macro

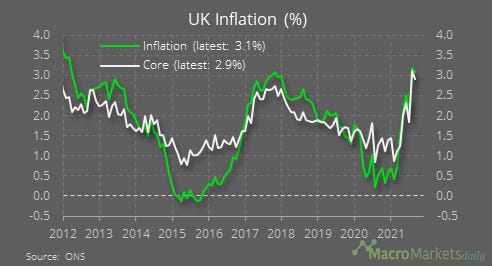

In the UK, inflation fell to 3.1% in September, while core inflation fell to 2.9%, but traders continue to bet the Bank of England will raise interest rates next month.

Inflation is even higher in Canada, reaching 4.4% in September. The Bank of Canada is meeting next week and interest rate swaps suggest it will release a more hawkish policy statement.

The weekly EIA report showed that US crude production fell by 0.1 mn barrels last week. It’s still far below the pre-Covid level.

The eurozone current account surplus has risen again to 2.2% pf GDP, though that hasn’t done a great deal for the euro lately.

Markets

Cyclical stocks are on the rise again compared to their defensive counterparts, whether you count the tech sector in that definition of cyclicals or not.

Growth stocks have yet to regain their high relative to value stocks, but are heading that way.

The use of call options is on the rise again, which seems to favour growth stocks more than value stocks judging by the previous peaks in call option volume outstanding.

The recent moves upward in yields has been all due to inflation breakevens – real yields have gone nowhere.

It was another strong day for the main cryptos yesterday as Ethereum pushes toward a new record high.

Like what you see? Please forward this email to your friends and colleagues, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily