Chart of the Day

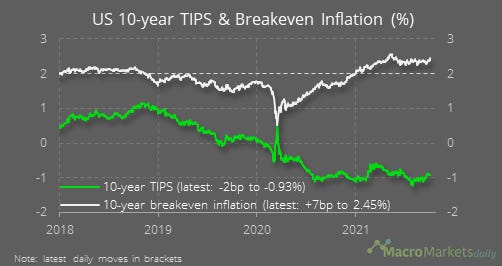

Bond yields have received a lot of attention in recent weeks, especially since the Fed delivered a hawkish message at its September meeting. In the past week, the upward trend in the 10-year has paused, with the yield falling by 2bp. There have still been some interesting moves under the hood, with the 10-year TIPS (real) yield falling 8bp while the breakeven inflation component, a proxy for investors’ inflation expectations, moved 6 bp higher. At 2.45%, the 10-year breakeven rate is still a bit below the 2.57% peak earlier this year. If it rises above that level, the Fed might start to get a bit more uneasy.

Macro

The ISM services index was barely changed in September – a weighted average of the ISM surveys rose to 62.1. That points to strong GDP growth of above 5% annualized, but the latest Atlanta Fed GDP tracker points to Q3 growth of a much lower 1%.

An average of the ISM prices paid indices rose in September and suggests inflation will stay above 4%.

The US August trade data showed exports rose by 0.5% MoM and imports increased by 1.4% MoM, causing the dollar trade balance to fall again.

In the UK, growth in car registrations is falling sharply again amid supply shortages – petrol shortages could put off a few buyers as well.

We have policy rate lift-off in New Zealand – expect more to come.

Markets

But remember the market is already pricing in tightening, hence why the NZD was little changed after the news.

There was a rebound in equities yesterday. A mixed set of performances by sector. Financials rising and real estate falling despite a relatively muted move in yields.

Traders are pricing in higher inflation in the coming five years than the five years after that (5-yr/5-yr = 2026-2030).

There’s been a very sharp rise in inflation expectations in the UK, which is one reason why the Bank of England has been sounding more hawkish.

Like what you see? Please forward this email to your friends and colleagues, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily