Chart of the Day

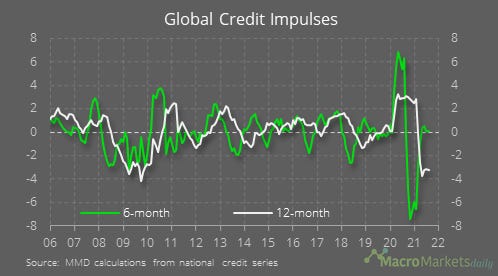

China’s credit data were released late on Tuesday and show the 12-month credit impulse deteriorated once again. While that appears to be a bad omen for various markets like commodities, we can see things are starting to improve on a six-month basis. That’s because most of the contraction in the flow of credit happened over six months ago now, as the government started to tighten credit to property developers and other over-indebted firms. Economists don’t expect a largescale loosening of credit from here, but heading toward a world in which Chinese credit conditions are no longer tightening should still be a positive development.

Macro

At the global level, the 6-month credit impulse has already turned neutral.

Core CPI inflation was unchanged in September at 4.0%, but both of the Cleveland Fed’s core measures rose sharply – that’s a bad sign for the Fed because those measures are supposed to better represent underlying inflation than the normal core series.

China’s September trade data showed export growth increased to 28.1% YoY, which was higher than economists expected and a good sign against the recent narrative of growth concerns there.

In the eurozone, industrial production fell by 1.6% MoM in August, as supply shortages hit output. Production was still up YoY though.

Markets

The tightening of credit in China hasn’t been that bad for commodities, in part because limited supplies have boosted the price of energy commodities like oil, natural gas and coal.

Copper and iron are diverging again, with copper also benefitting from supply concerns – that’s despite concerns copper would do poorly against the drop in demand from the Chinese housing construction sector.

EM currencies could benefit from the rise in the Chinese credit impulse.

Nominal bond yields are rising, but real yields have dropped back – that’s helped gold prices. The real 10-year US yield fell by 6bp yesterday, while gold rose by 2.0%.

The 30y-10y yield curves for major advanced economies have been flattening. At first, that was because 10-year yields were rising. But lately, 30-year yields have been falling – that is probably because markets are no longer as worried about the Fed letting inflation get out of hand.

Like what you see? Please forward this email to your friends and colleagues, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily