Chart of the Day

The latest Chinese credit data, for January, showed an improvement in the six-month credit impulse, to the most positive since early 2021. This shows that China is slowly loosening the credit taps in response to its property market downturn, which should be good news for several markets, including Chinese equities following their poor year in 2021 – providing the authorities don’t decide otherwise.

Macro

The 12-month credit impulse is still fairly negative, but it’s the six-month impulse that tells us the most about recent trends.

There’s been lots of talk about a strong dollar as the Fed tightens, but an improving Chinese credit impulse normally coincides with a weaker USD.

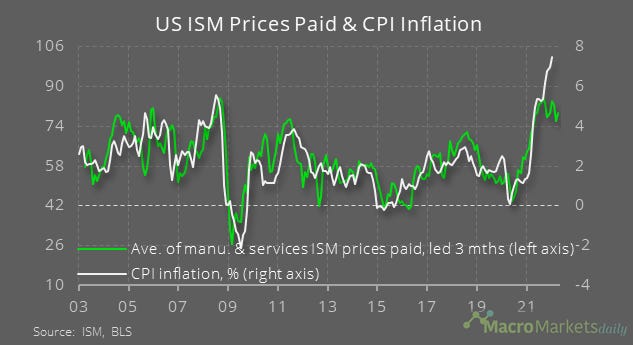

US CPI inflation rose to 7.5% in January, 0.2%-pts higher than expected – though the business surveys point to lower inflation ahead.

Across the main categories, inflation ranged from 1.4% for medical goods to 40% for used vehicles.

In response to higher inflation, the US-10 year yield rose above 2% for the first time since the pandemic.

There’s some concern about debt sustainability in Italy as yields rise by more than elsewhere.

The high inflation number triggered weakness in US markets – well, they fell, rebounded, and then fell some more in the afternoon session, once European markets were closed.

Like what you see? Please forward this email to your friends and colleagues and tell them to sign up at www.macromarketsdaily.com, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily