Chart of the Day

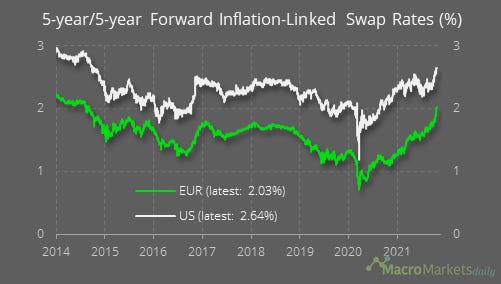

For all the talk of whether inflation is transitory or not in the US, the 5-yr/5-yr inflation swap – basically representing the 2027-31 period now – has risen by far more lately in the eurozone, where it is now above 2% for the first time since 2014. It is still lower than in the US, but that is a striking development in light of the more structural reasons economists often cite for why inflation will remain lower in the eurozone than elsewhere, not least the institutional set-up which has already shown its low-inflation bias since the euro’s inception.

Macro

There was bad news for the eurozone from the German Ifo survey, as the expectations component fell to 95.4 in October, leaving it consistent with GDP growth of 0% YoY.

The Dallas Fed manufacturing sector survey rose in October, but these surveys are currently being kept up by the components related to supply times rather than production expectations, which are weakening.

The Chicago Fed activity index is a better indicator and shows a further slowdown in growth.

Markets

Despite the large rise in the EUR inflation swap, the German 10-year is still negative.

The gap between the VIX and MOVE remained in place at the start of the weak, as traders remain nervous about the prospect of further moves in bond yields triggered by hawkish central banks.

The ratio of the S&P 500 industrials to utilities sectors has yet to regain its recent high as concerns remain about the growth outlook.

Turkey’s lira has been pummeled by the rate cuts there, which go against orthodox policy-setting in the high-inflation country.

Despite the Evergrande crisis, there has been little move in the CNY against the USD.

Gold and silver are on the move again, perhaps finally benefitting from some concerns about inflation.

Like what you see? Please forward this email to your friends and colleagues, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily