Greetings,

United States: The FOMC minutes contained few surprises and were perhaps a bit less hawkish than markets expected. There doesn’t seem to be much urgency to get moving on QE tapering. Some members expressed concerns about MBS purchases contributing to rapid home price gains, but there wasn’t consensus on prioritizing these securities.

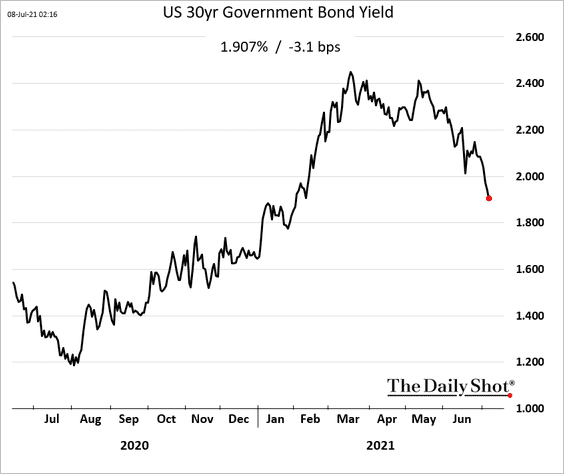

Treasury yields keep moving lower, with the 30yr yield now firmly below 2%.

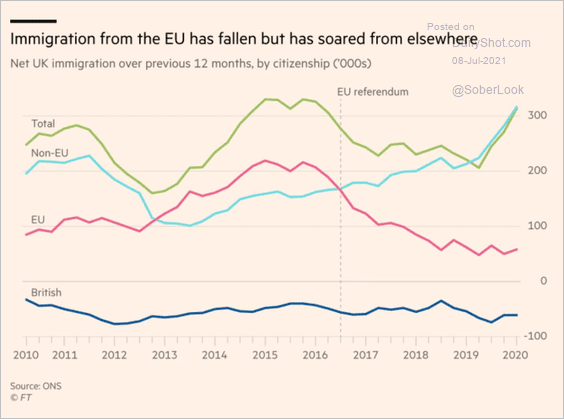

United Kingdom: Immigration is nearly back to pre-Brexit highs, although fewer immigrants are from the EU.

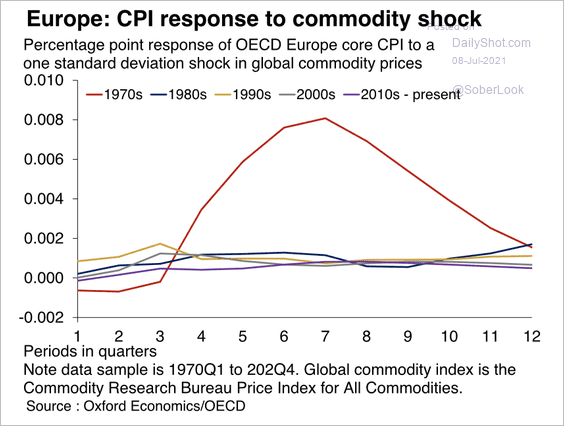

Europe: The link between inflation and commodity prices has broken down since the 1980s.

China: Household assets continue to climb.

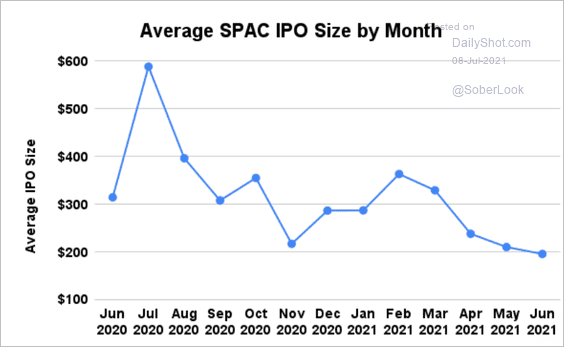

Equities: SPAC IPOs have been smaller lately.

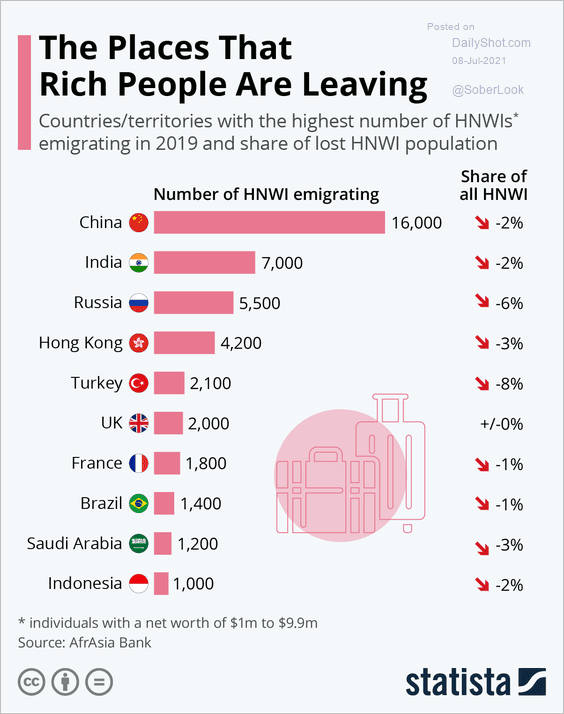

Food for Thought: Countries that high-net-worth individuals are leaving:

Edited by Richard Holmes

Contact the Daily Shot Editor: Editor@DailyShotLetter.com