Greetings,

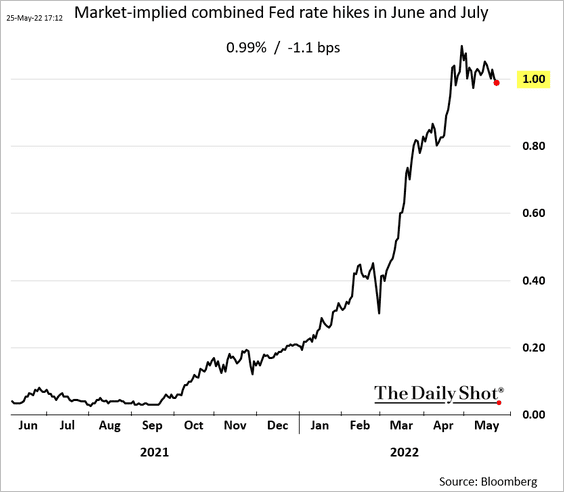

United States: First, the FOMC minutes did not suggest a 75 bps hike in the months ahead. The market has even started pricing in a very small probability that we may not even get the full 50 bps hikes over the next two months if economic growth hits a wall.

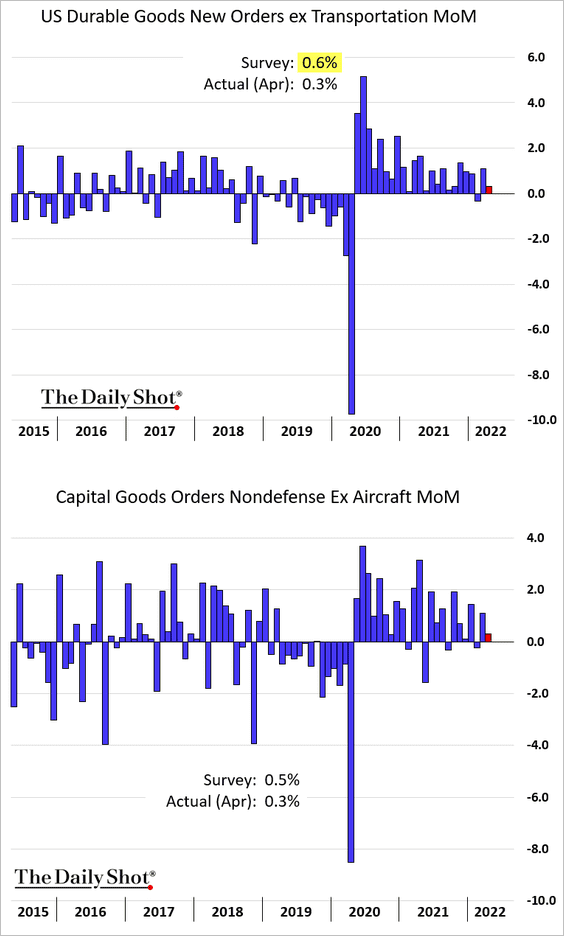

Durable goods orders were softer than expected last month, a sign that GDP growth may be slowing.

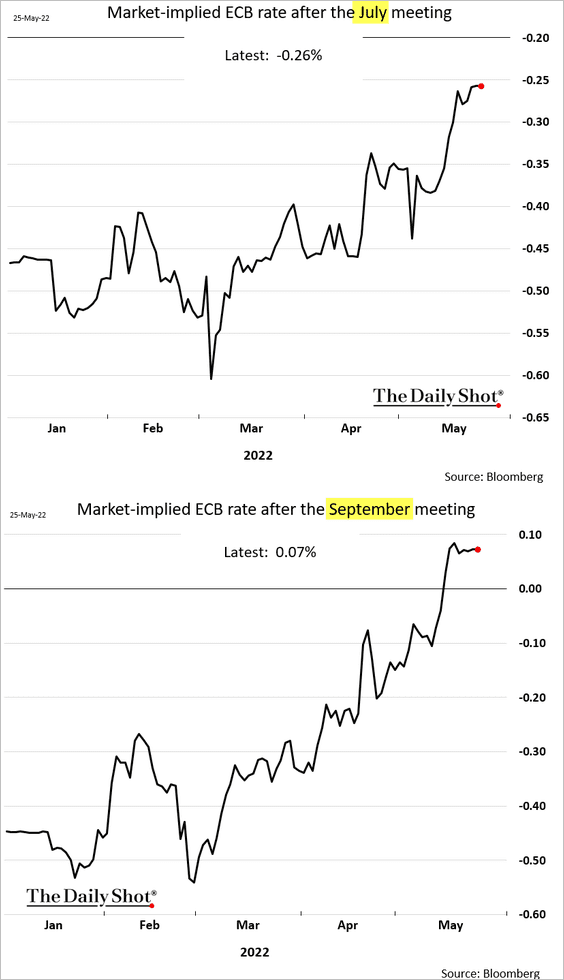

The Eurozone: The market expects 25 bps rate increases, a size significant for the ECB which hasn’t raised rates since 2011. Some central bankers want to leave 50 bps increases on the table.

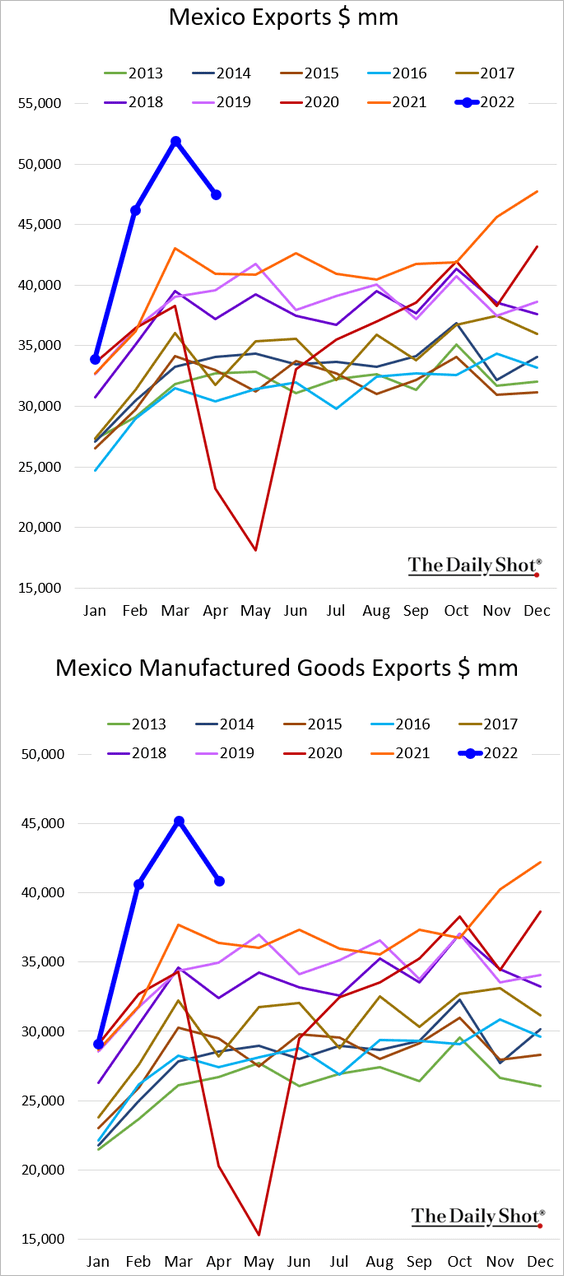

Emerging Markets: Mexican exports declined more than expected in April but are still elevated.

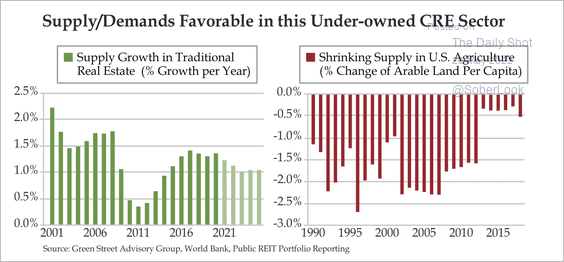

Commodities: The supply of US arable land has declined significantly. That’s partly because of the repurposing of what was once farmland into commercial real estate and transport networks, according to Quill Intelligence.

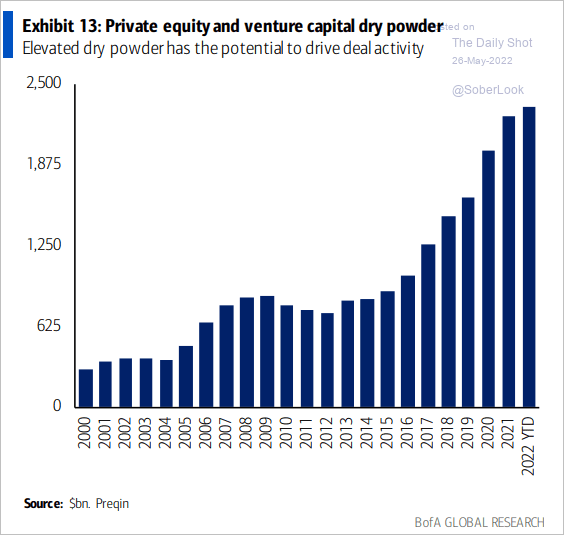

Equities: Massive amounts of private equity dry powder are a tailwind for the stock market.

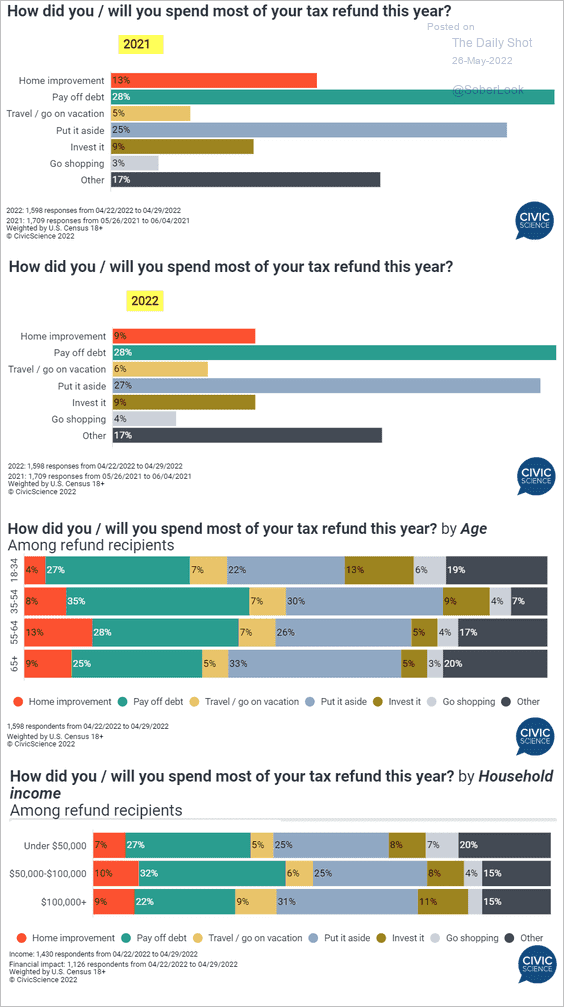

Food for Thought: To conclude, here is how tax refunds are being spent:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com