Greetings,

Equities: First, Beijing announced additional support for its economy and markets.

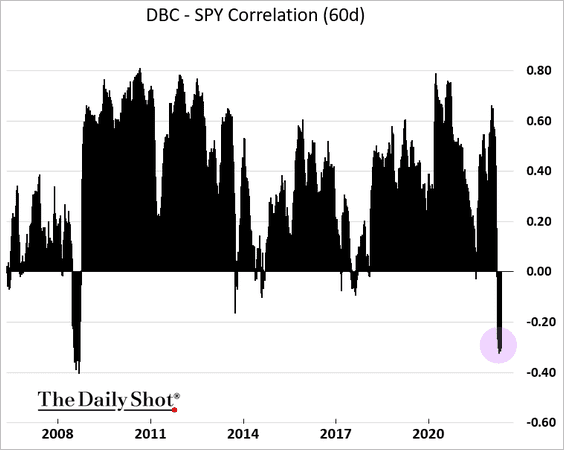

Although the stimulus would be thought to boost global stocks, improving growth in China could strengthen commodity prices and accelerate inflation. The correlation between commodities and stocks is now at its most negative since the financial crisis.

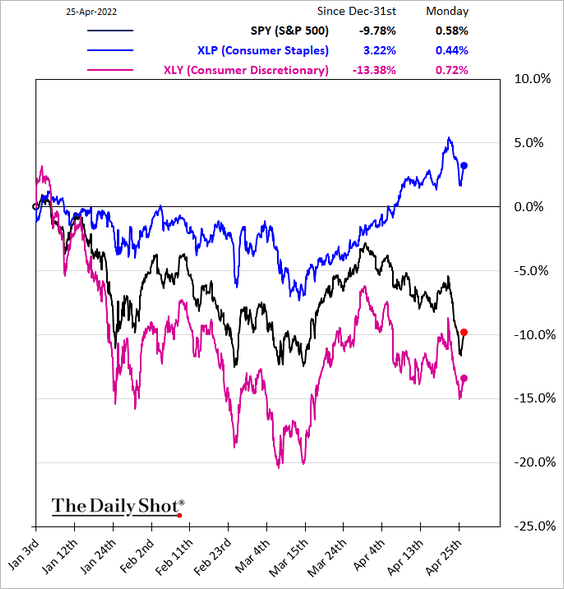

Defensive sectors, such as consumer staples, have been outperforming.

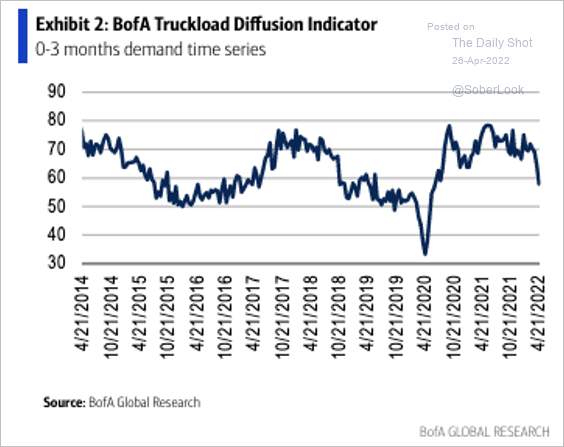

United States: In the US, economic momentum is weakening. Softer demand is showing up in slower truck activity.

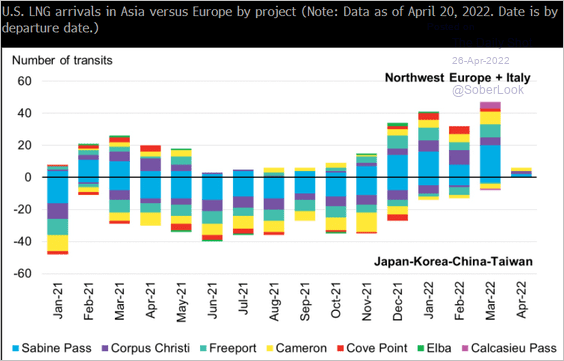

Energy: Next. here are US LNG exports by liquefication source and the balance of Asia/Europe destinations

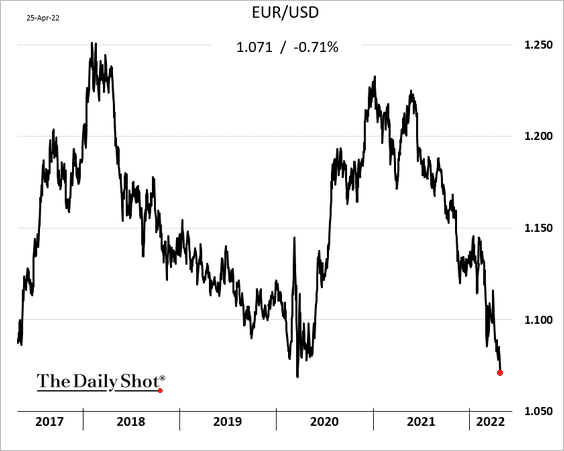

Eurozone: The euro is nearing the 2020 lows. This comes amid heightened recession worries.

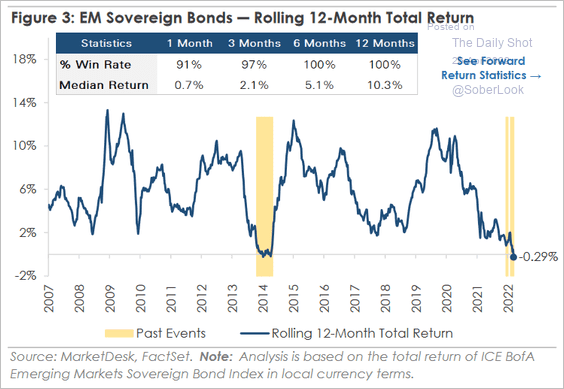

Emerging Markets: It’s been a tough 12 months for EM sovereign bonds. This comes as the inflation surge becomes increasingly broad based.

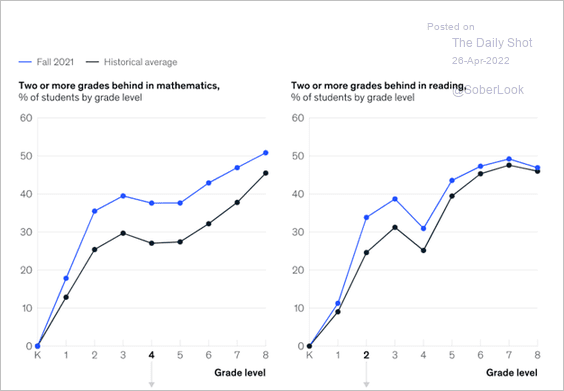

Food for Thought: Lastly, let’s take a look at student performance during COVID:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com