Greetings,

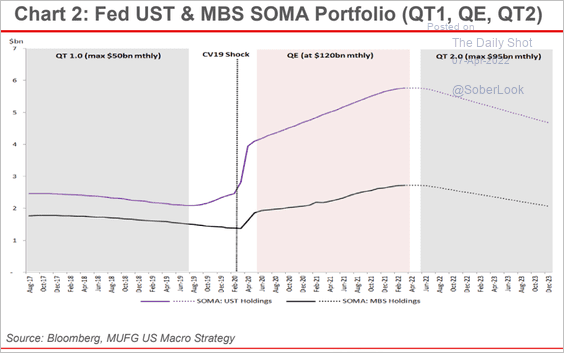

The United States: The FOMC minutes confirmed the Fed’s quantitative tightening program aims to trim its Treasury holdings by $60 billion, and its MBS holdings by $35 billion, per month. At some point, the Fed will sell MBS debt outright because the runoff is expected to be too slow to meet the reduction targets (due to low mortgage refi activity).

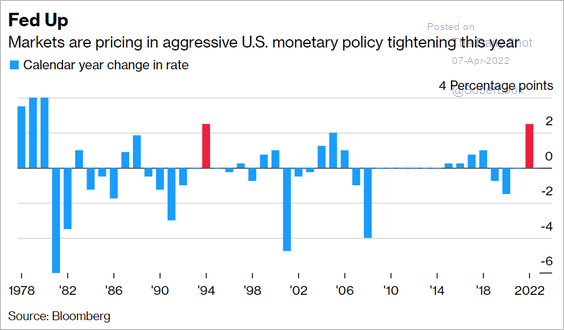

It’s been a while since the Fed tightened this aggressively.

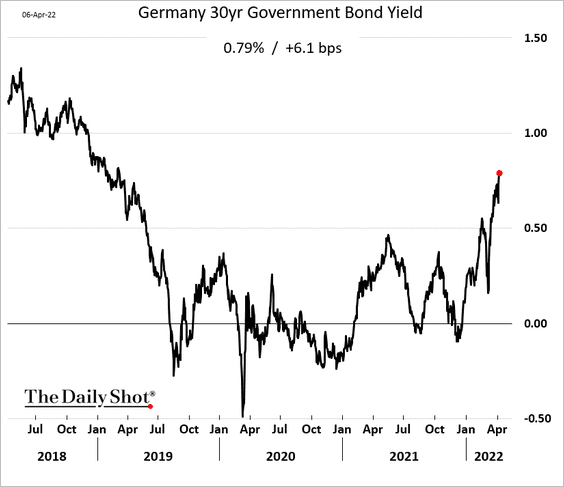

The Eurozone: Alongside growing fears of a potential recession in Germany, the 30-year Bund yield continues to climb.

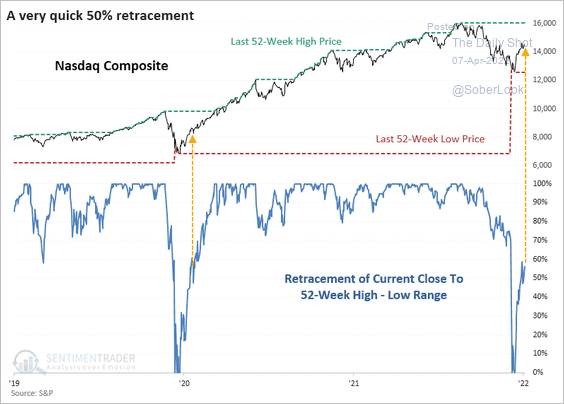

Equities: The Nasdaq’s recovery from its recent 52-week low looks similar to the 2020 rebound.

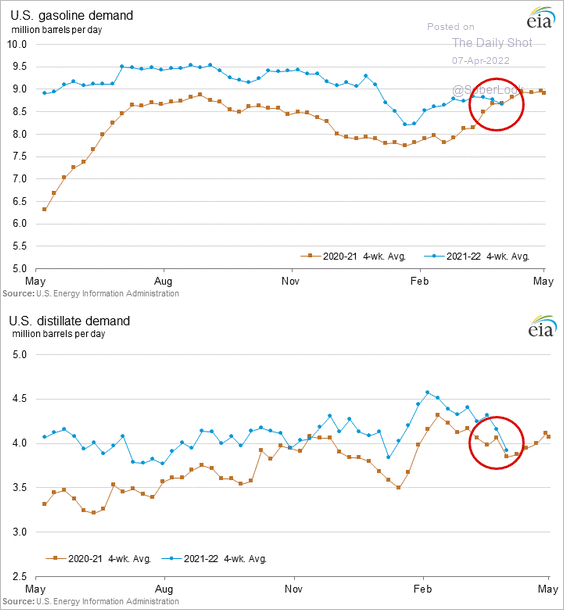

Energy: In energy markets, US refined products demand is showing signs of fatigue as prices surge.

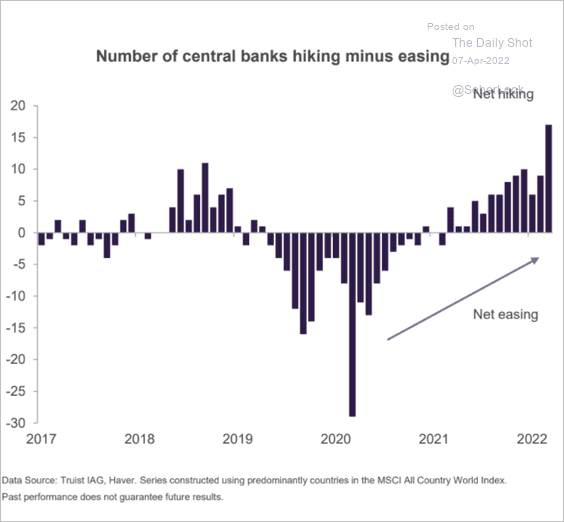

Global Developments: The net number of central banks hiking rates hit a multi-year high, which does not bode well for global economic growth.

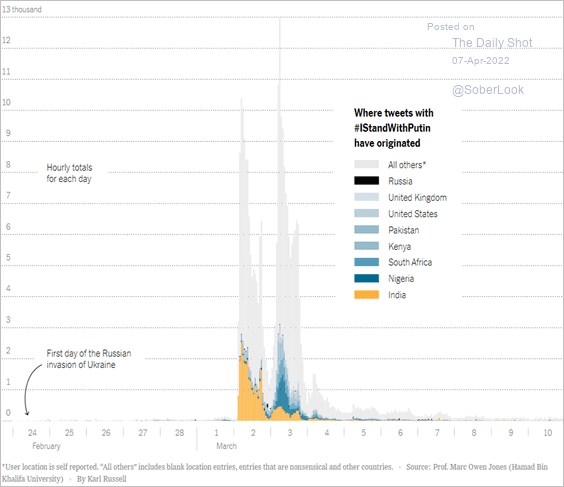

Food for Thought: Lastly, here are the origins of #IStandWithPutin tweets.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com