Greetings,

Administrative Update: The Daily Shot Brief will not be published the week of December 27th.

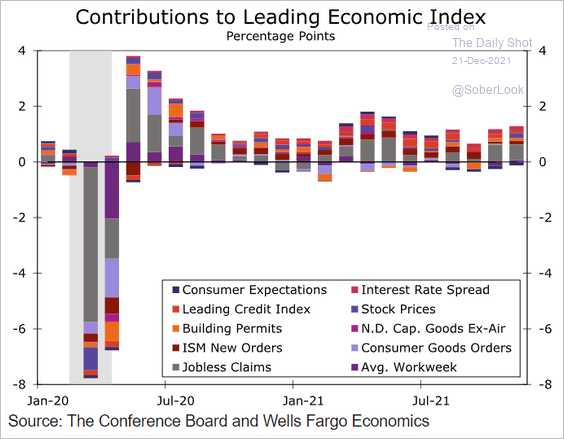

United States: The Conference Board’s leading index continues to point to robust economic activity ahead. Falling unemployment claims have been the key driver of this indicator over the past couple of months.

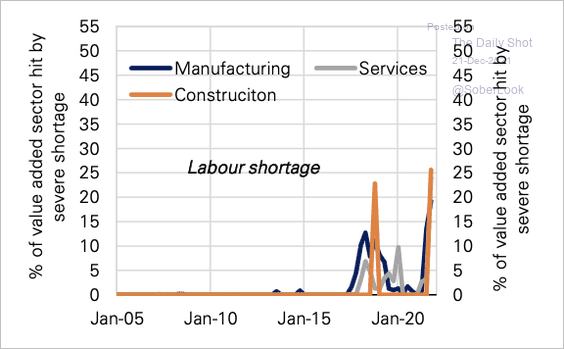

Eurozone: More euro-area firms are reporting severe labor shortages, especially in manufacturing and construction.

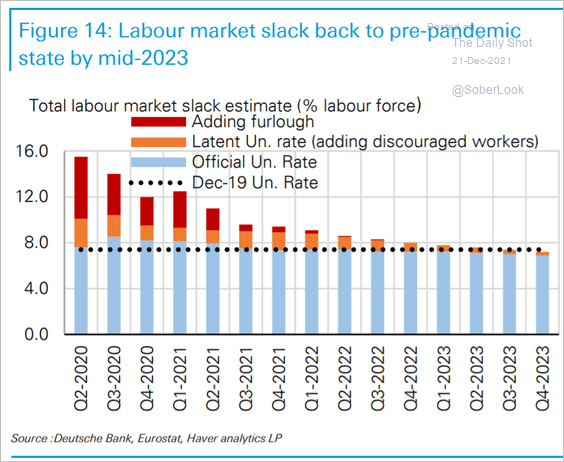

Labor market slack is expected to return to pre-pandemic levels around mid-2023.

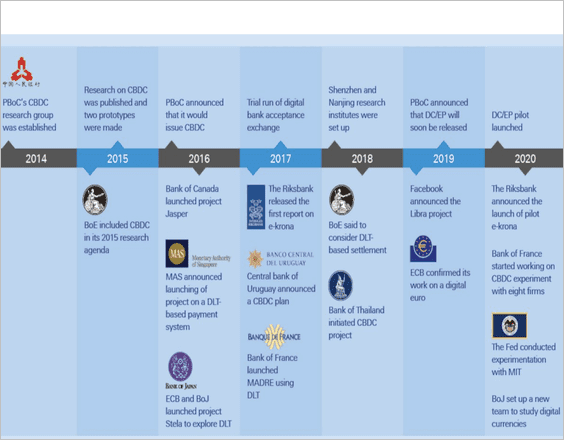

Cryptocurrency: Here is a timeline of central bank digital currency (CBDC) research and experiments in various countries.

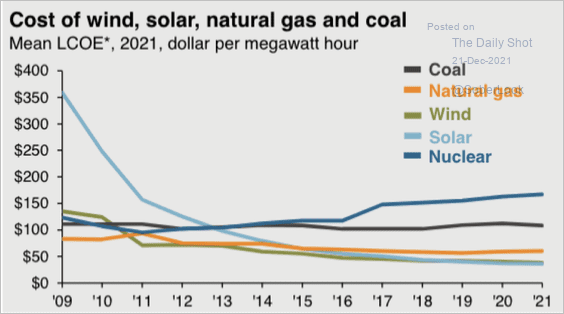

Energy: Solar has become significantly cheaper over the past decade and is now less expensive than other energy sources.

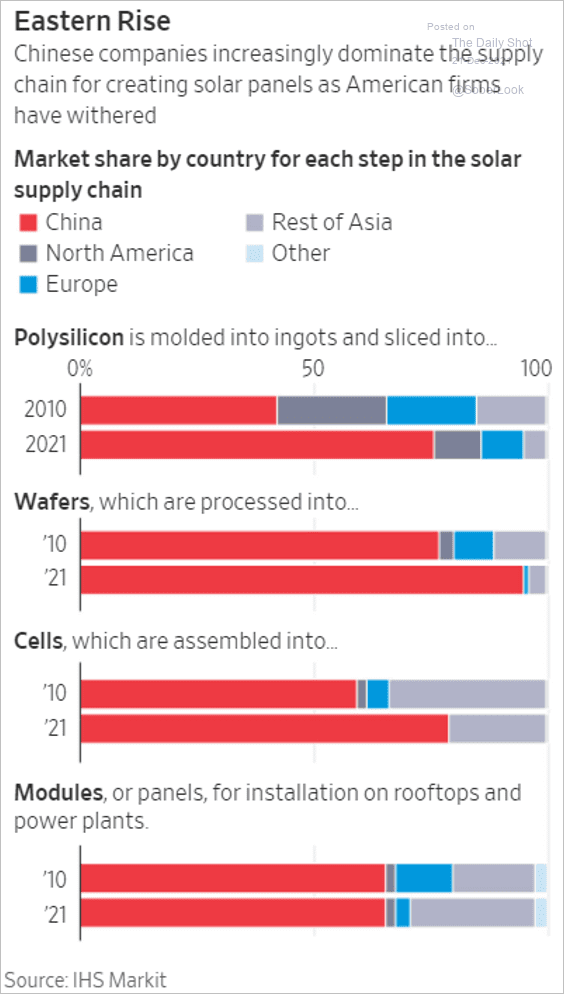

But prices are going up this year. China controls the solar panel supply chain.

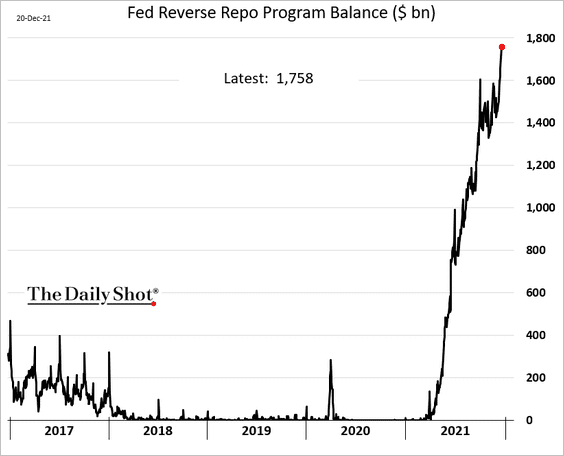

Rates: The Fed’s reverse repo facility balance hit a record high as European banks deposit dollars. Also, dealers have been reducing their balance sheets before the year-end and use this facility to park cash.

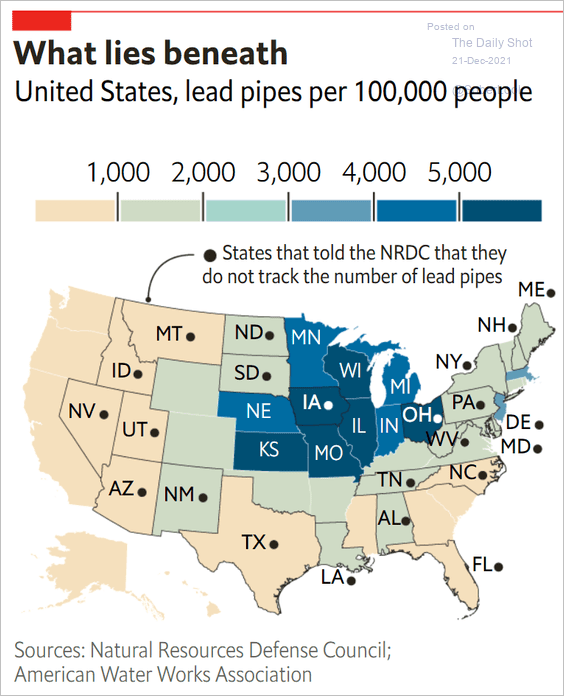

Food for Thought: Concentration of lead pipes:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com