Greetings,

China: Debt of leveraged property companies remains under pressure. However, analysts doubt that the property debt crunch is China’s “Lehman moment.”

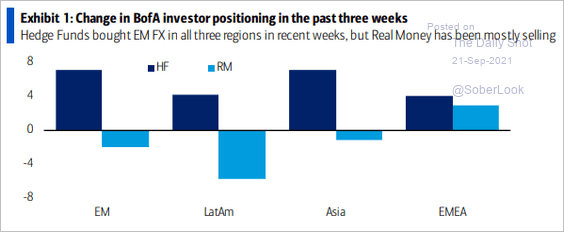

Emerging Markets: Hedge funds have been buying EM currencies in recent weeks.

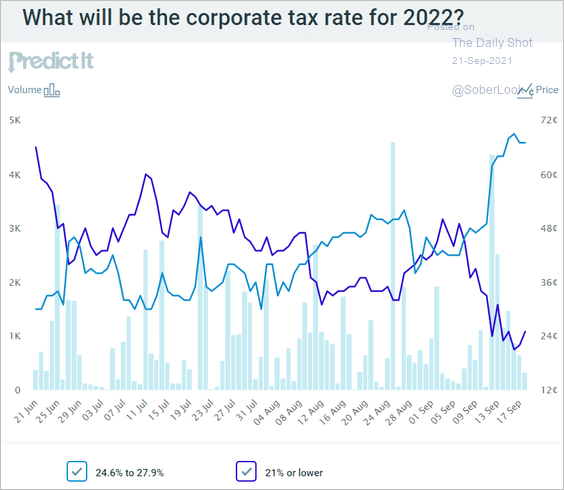

Equities: Other US domestic issues also pose risks, including tech regulation and a potential surprise from the Fed (perhaps due to more persistent inflation). For example, corporate and capital gains tax hikes:

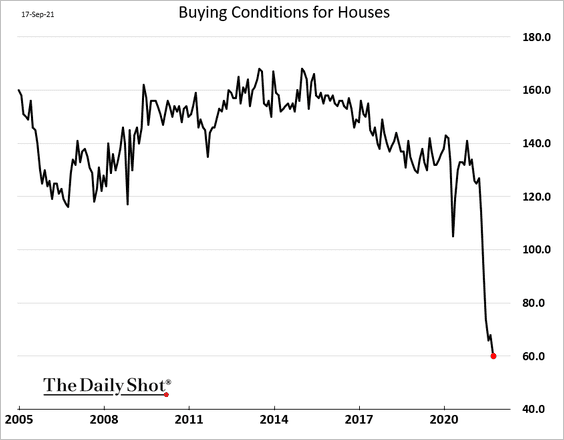

United States: Consumers’ views on buying conditions for homes continue to deteriorate, according to the latest U. Michigan survey.

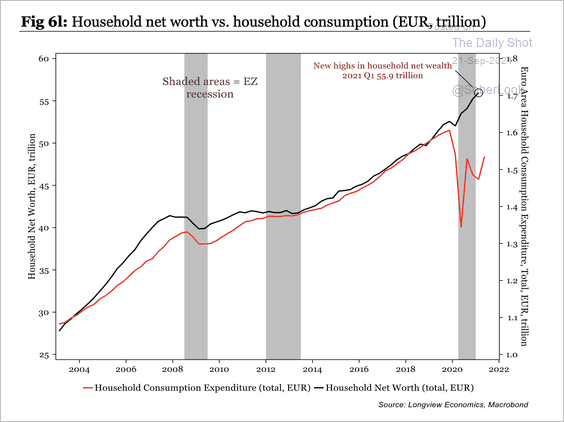

Eurozone: Consumption in the Eurozone tends to follow household net worth, implying further upside.

Food for Thought: All the dice in the figure below are perfect squares.

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com