Greetings,

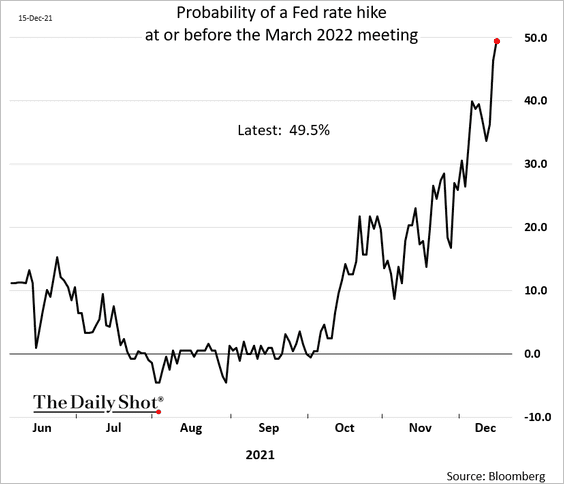

United States: The FOMC delivered a widely anticipated hawkish shift to tackle surging prices. As expected, the central bank will double the pace of taper. That change opens the possibility of a rate hike as early as March. The market now sees even odds of such an outcome.

The FOMC boosted its inflation forecasts.

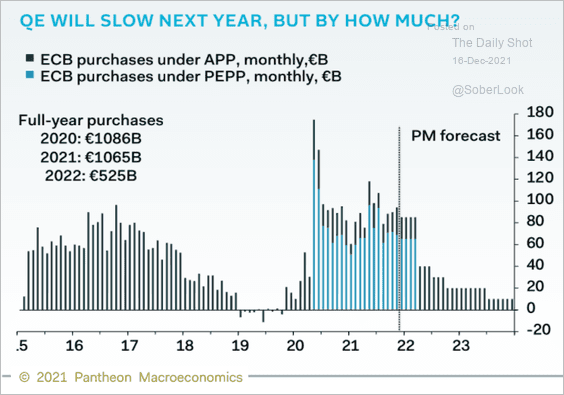

Eurozone: How much will QE slow next year? Below is an estimate from Pantheon Macroeconomics.

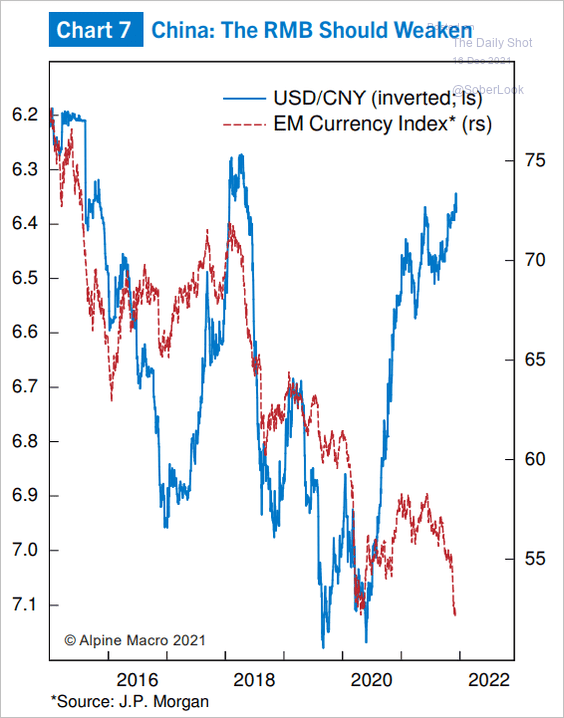

Emerging Markets: The renminbi has decoupled from other EM currencies.

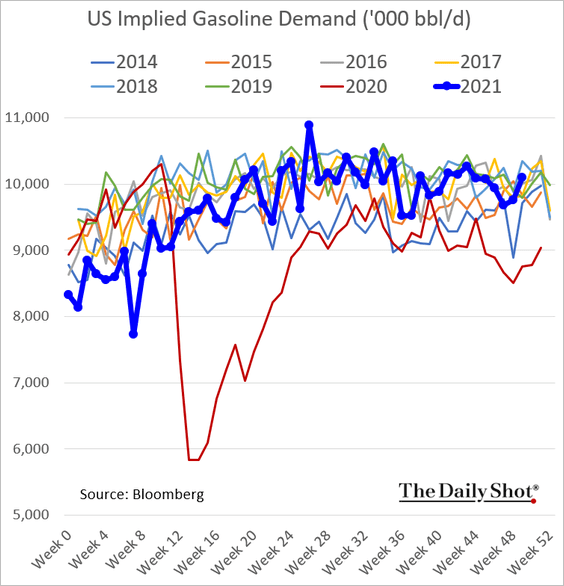

Energy: US gasoline demand firmed up last week.

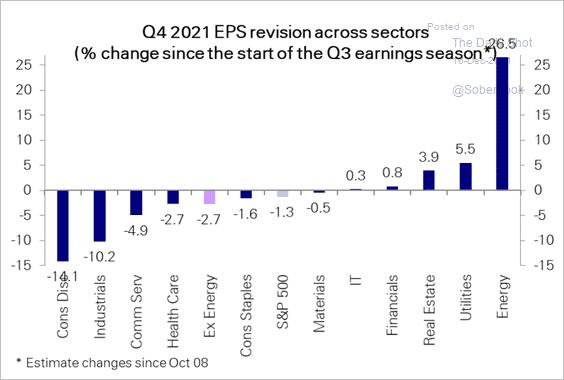

Equities: Q4 earnings estimates came down in a number of sectors.

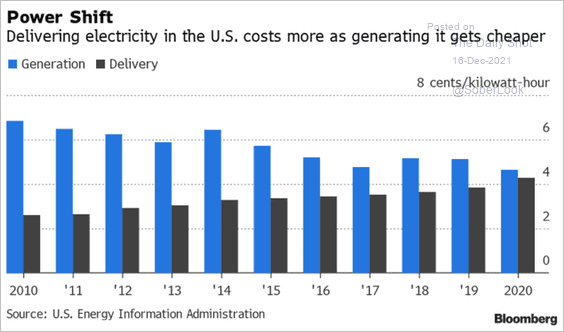

Food for Thought: Power delivery costs:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com