Greetings,

United Kingdom: Despite a surge in inflation this year, major central banks are not as eager to hike rates as the markets feared. In recent days, that has been the lesson from the ECB, the Fed, the RBA, and now the BoE. The UK’s central bank surprised the markets by holding rates unchanged. To be sure, the BoE will probably hike in December, but there doesn’t seem to be the urgency that was priced into the markets.

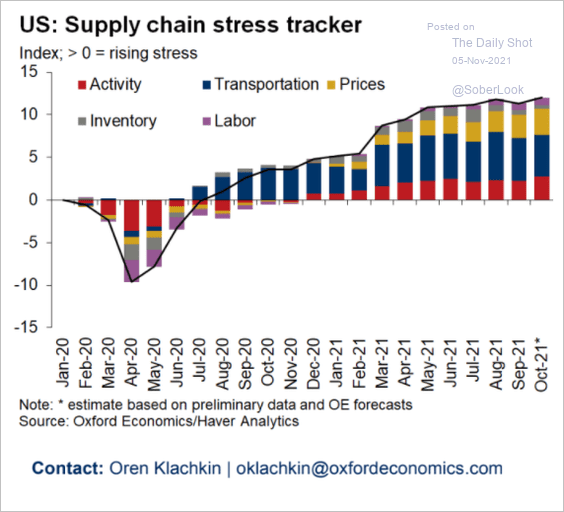

United States: The Oxford Economics supply chain stress tracker shows no signs of easing.

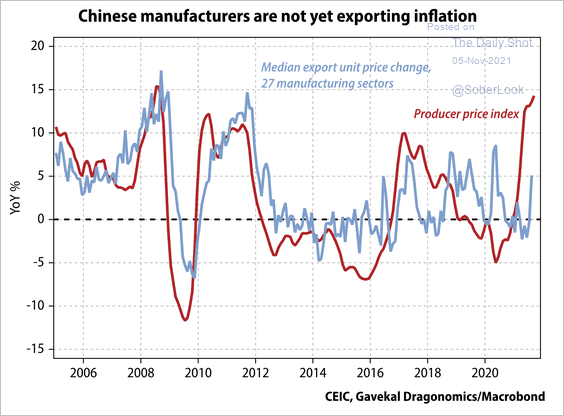

China: China continues to be a disinflationary force by not passing through rising materials prices into exports. Is this trend sustainable?

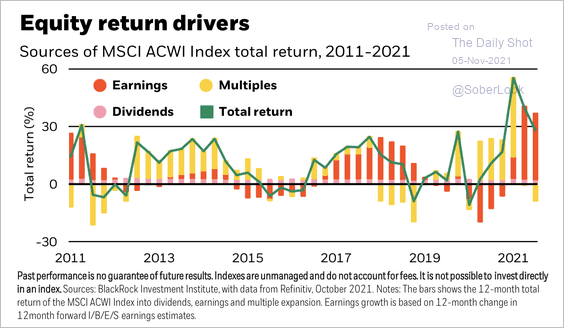

Equities: BlackRock expects earnings growth to normalize as economic activity settles.

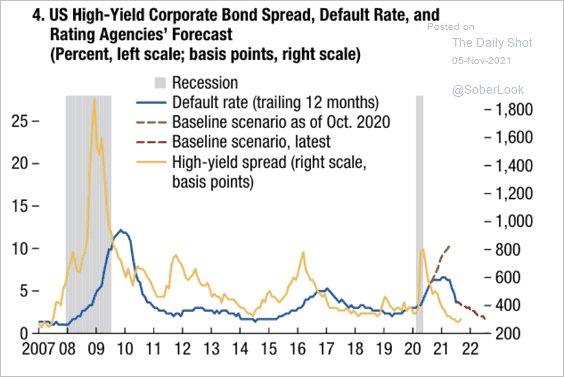

Credit: Based on the high-yield spread and rating agency projections, default rates for risky bonds are expected to continue lower over the next year.

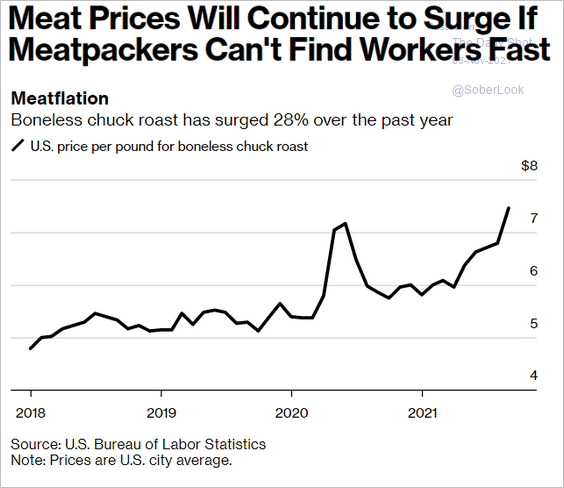

Food for Thought: US meat prices:

Edited by Devon Lall

Contact the Daily Shot Editor: Editor@DailyShotLetter.com