Greetings,

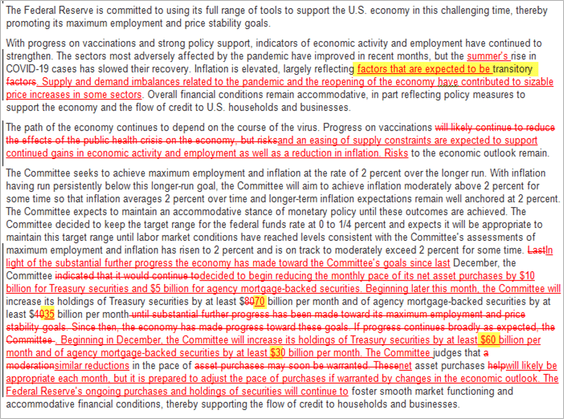

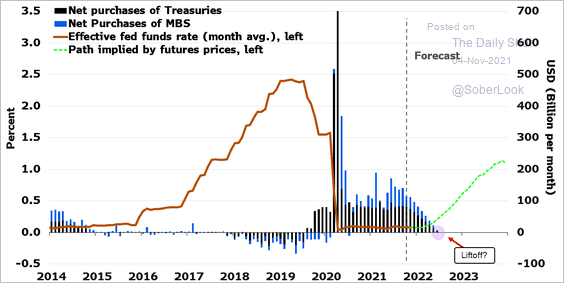

United States: The Federal Reserve will start tapering securities purchases this month. The initial reductions will be $10 billion in Treasuries and $5 billion in MBS per month, targeting completion for next June. The central bank left itself the option to adjust the pace of tapering.

The central bank still sees inflation as transitory. However, there was a subtle change in the language from “largely reflecting transitory factors” to “reflecting factors that are expected to be transitory.”

Will we see liftoff right after tapering is complete? Much will depend on the labor market recovery, but the Fed could be shifting its views on “maximum employment.” There is a realization that some of the workers who left the labor force are not returning, and the labor market could keep tightening.

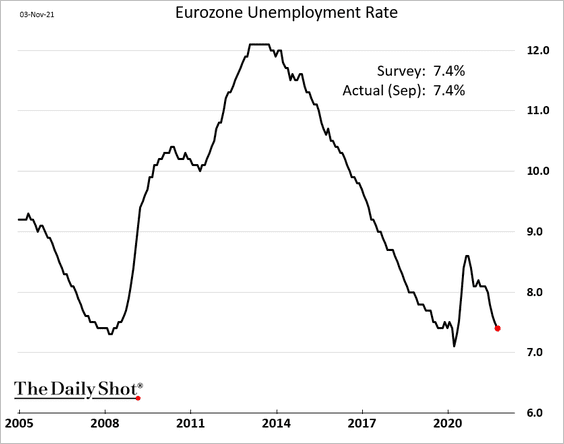

Eurozone: The unemployment rate continues to move lower, and economists expect the trend to continue.

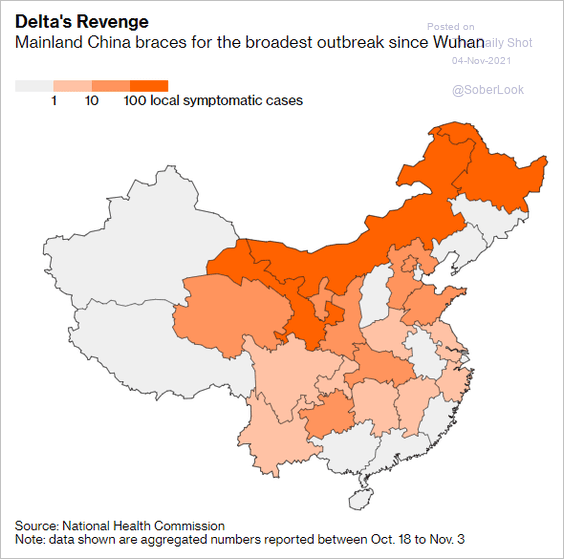

China: COVID is spreading again.

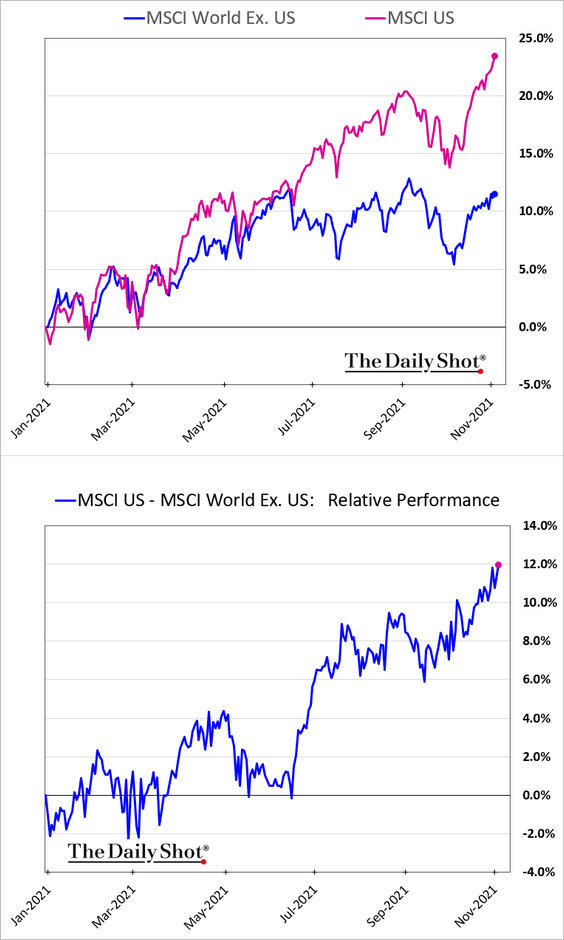

Equities: US stocks continue to widen their outperformance vs. the rest of the world.

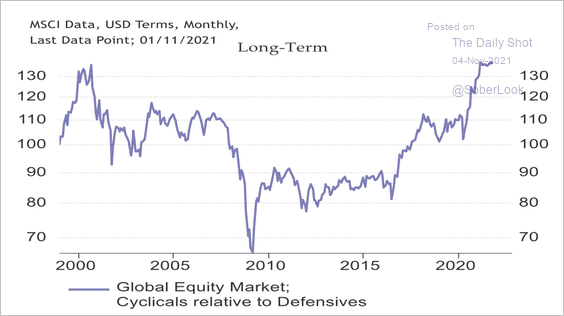

Global Developments: The global cyclical/defensive stock ratio is back near 2000 highs.

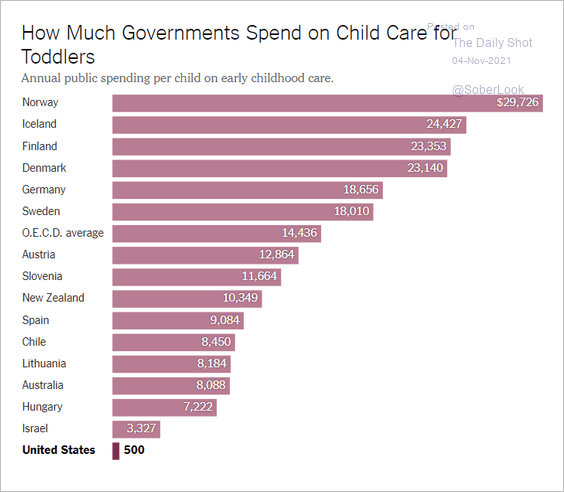

Food for Thought: Social spending on child care for toddlers:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com