Chart of the Day

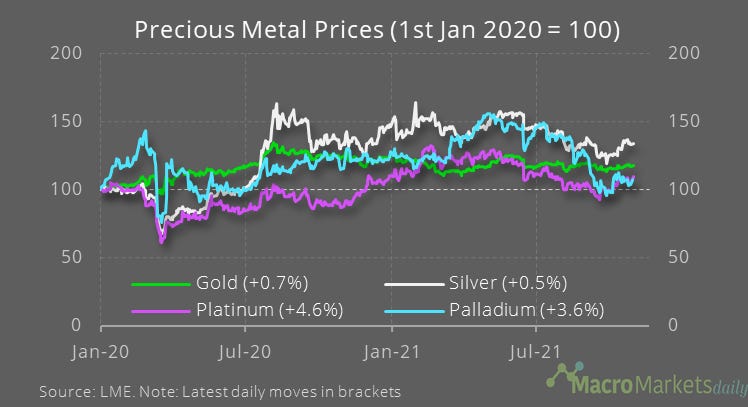

It was a strong day for platinum and palladium yesterday. Neither metal has broken convincingly out of their recent trading ranges, but this does raise the question of whether each metal could soon benefit from the restart of car production. Palladium especially started the year strongly thanks to the narrative that it would benefit from increased EV production across the world, but both then performed poorly from Q2 as global car production sank. Now, we’re hearing from some carmakers, such as General Motors, that they hope to have production restarting again this month. And with gasoline prices now so high, demand for EVs is probably even higher.

Macro

The prices paid component of the manufacturing ISM rose in October and suggests inflation pressures are holding steady.

US construction spending growth fell to 8.6% YoY in August. Residential spending growth stands at 23.9% while non-residential growth is at -3.0%.

German retail sales fell by 2.5% MoM in September, though they are still higher than before Covid hit.

Markets

Yesterday the Russell 2000 outperformed sharply. The Nasdaq has outperformed the other major US indices in the past week though, rising by 2.5% while the S&P 500 rose by 1.0%.

The Dow Jones Transportation Average is continuing to edge up, normally a good sign of market breadth.

Tesla continues to storm ahead despite its already very strong run.

Iron is falling further, although copper is holding its ground amid reduced supplies.

The EM currencies are under renewed pressure amid concerns about tighter monetary policy in advanced economies.

Like what you see? Please forward this email to your friends and colleagues, or use the button below to share it on social media. They can also follow us https://twitter.com/macro_daily