Greetings,

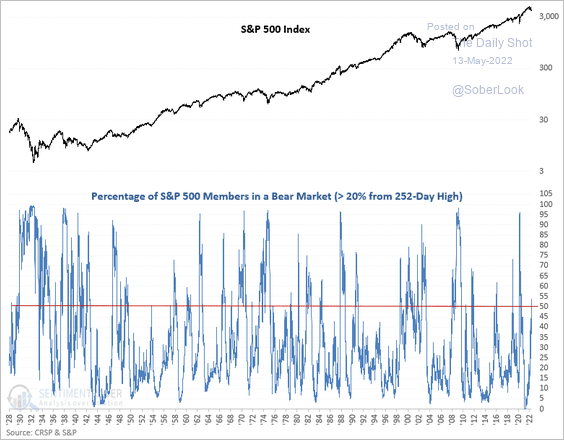

Equities: To begin, over half of S&P 500 stocks are in a bear market (down 20% or more from their 52-week highs).

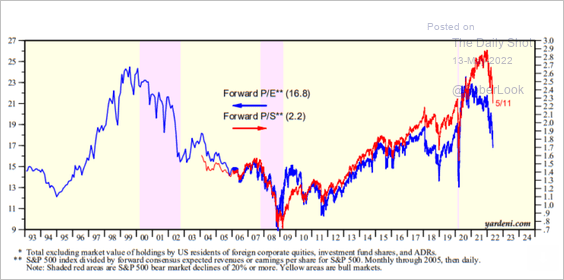

The market expects slower economic growth/recession to cut both revenues and margins, pushing PE ratios sharply lower.

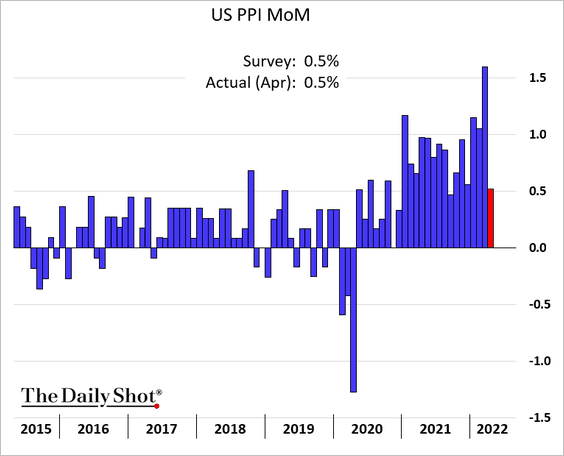

The United States: The April PPI print was roughly in line with expectations. However, there were signs in the PPI report pointing to some moderation in the PCE inflation index (which will be reported later this month)

– Headline PPI (month-over-month):

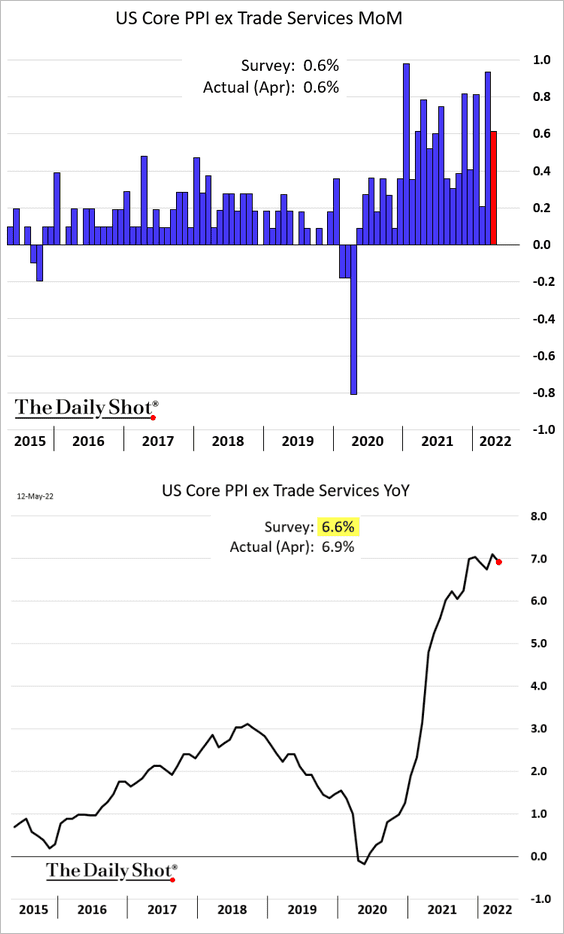

– Excluding trade services (business makeups), the core PPI is still running hot

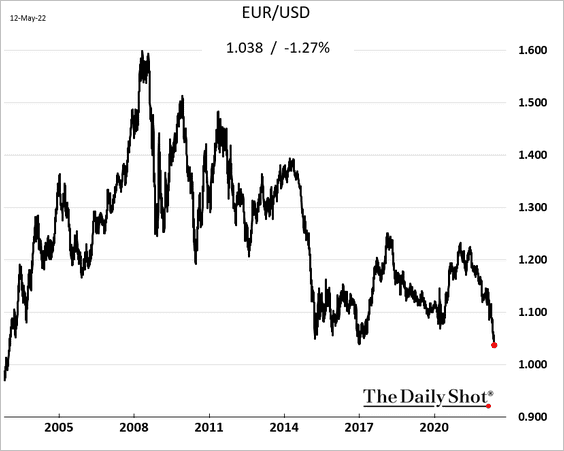

The Eurozone: The euro is near a 2-decade low vs. the USD.

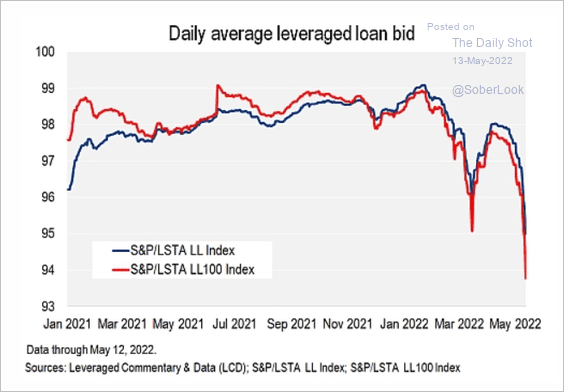

Credit: In credit markets, May has been a tough month for leveraged loans.

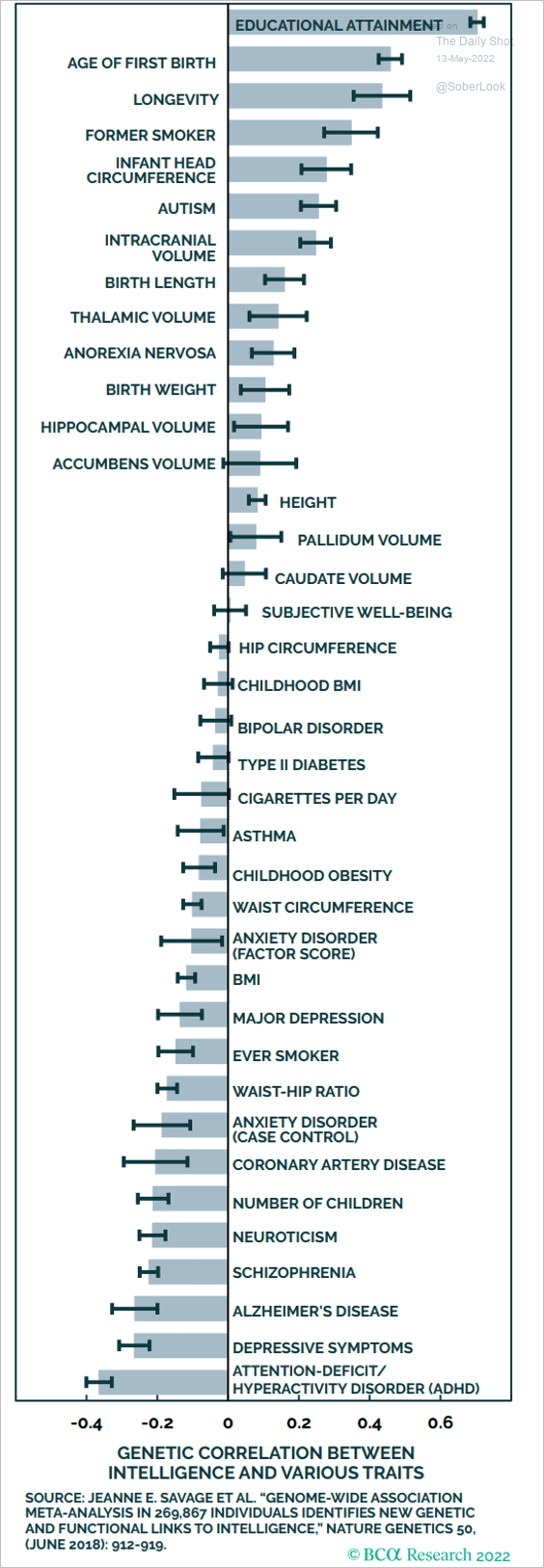

Food for Thought: Lastly, let’s take a look at correlations between IQ scores and various traits:

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com