Greetings,

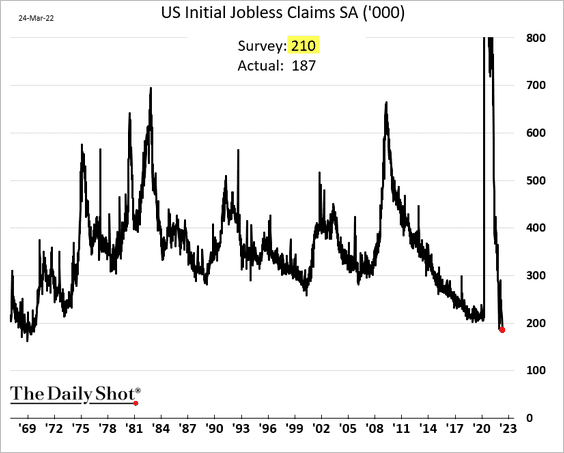

The United States: To begin, we have an update on the labor market. The seasonally-adjusted indicator for initial jobless claims is at its lowest since 1969, when the US population was much smaller.

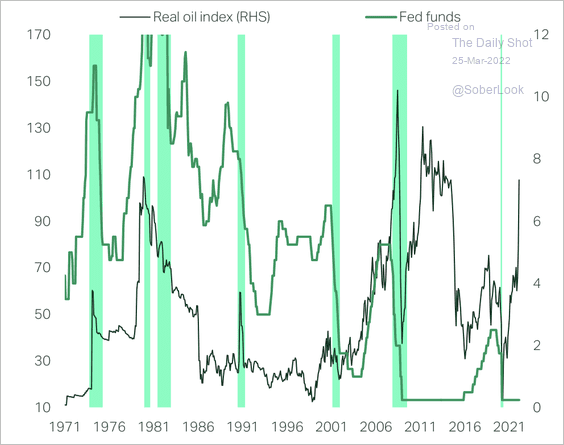

The tightening of the labor market comes as the Fed weighs a 50bps rate increase. Historically, tighter monetary policy combined with rising oil prices has preceded recessions.

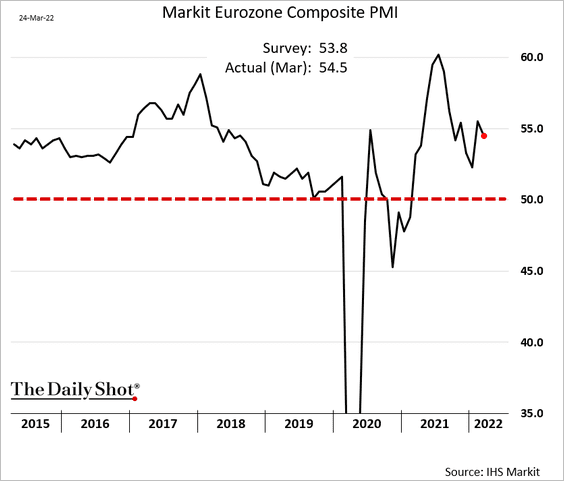

The Eurozone: Business activity was surprisingly resilient in the Eurozone this month, given the geopolitical/inflation backdrop. Here is the Eurozone composite PMI (above consensus).

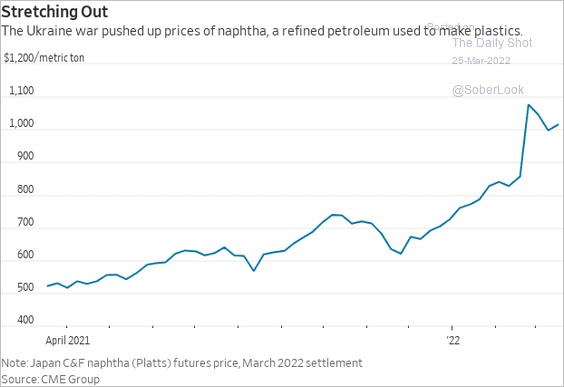

Commodities: In commodity markets, plastic costs are going up with crude oil.

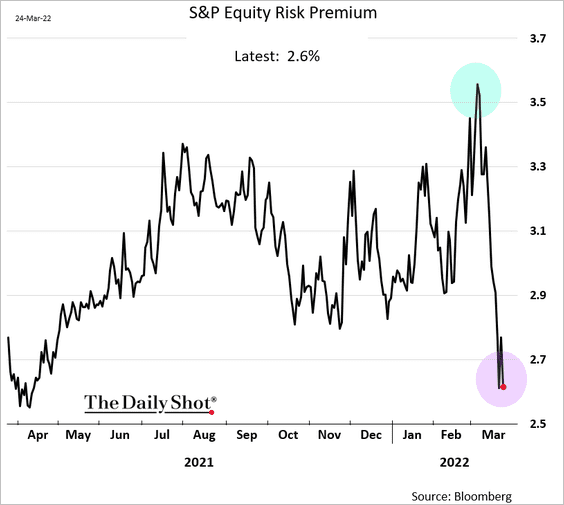

Equities: Equity risk premium shifted from relatively attractive to expensive levels in a matter of days.

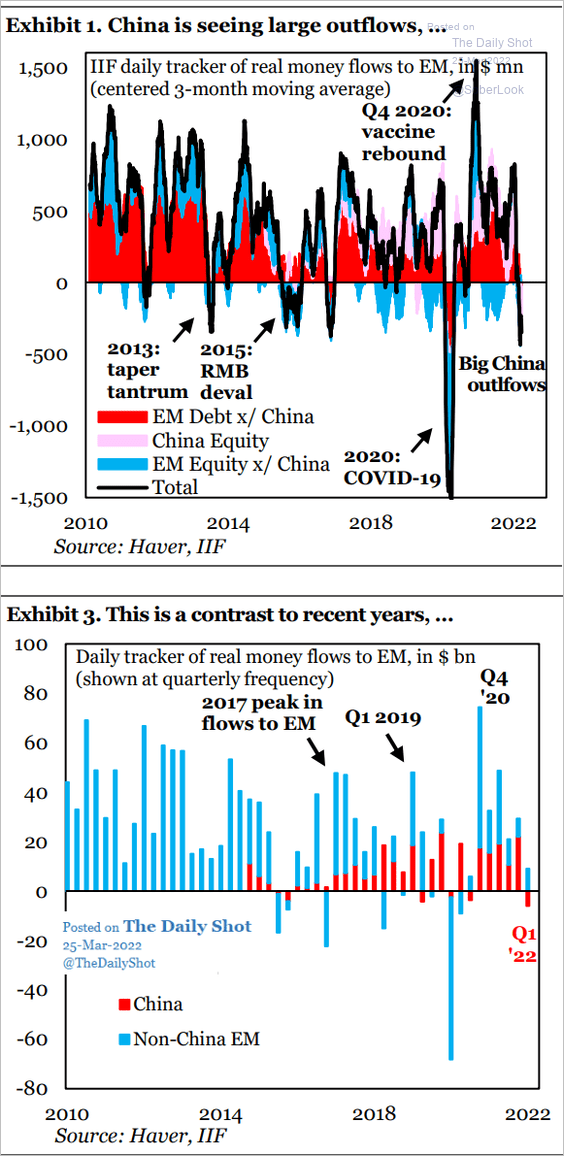

Emerging Markets: In contrast to other EM economies, China’s money flows have turned negative.

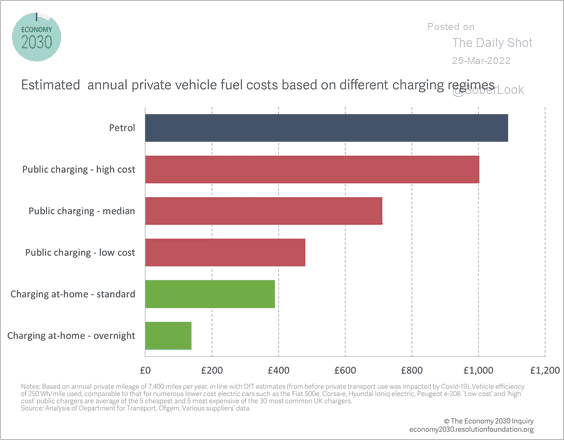

Food for Thought: Lastly, let’s look at private vehicle charging vs. fuel costs in the UK.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com