Greetings,

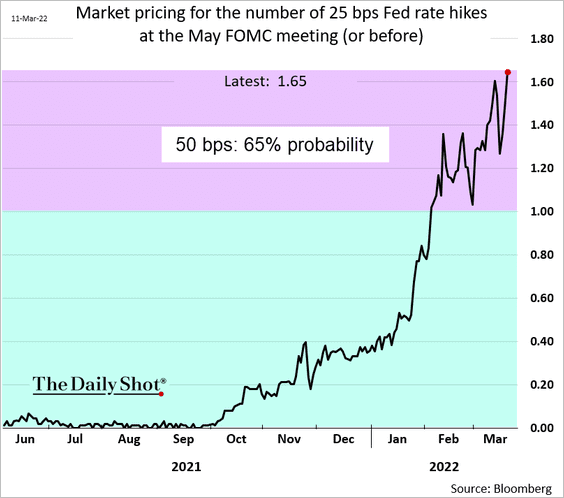

Rates: There was more hawkish rhetoric from Jerome Powell on Monday, indicating that he is open to one or more 50 bps rate hikes. His remarks to the National Association for Business Economics come as the probability of a 50bp increase in May (as opposed to 25bps) climbed above 60%.

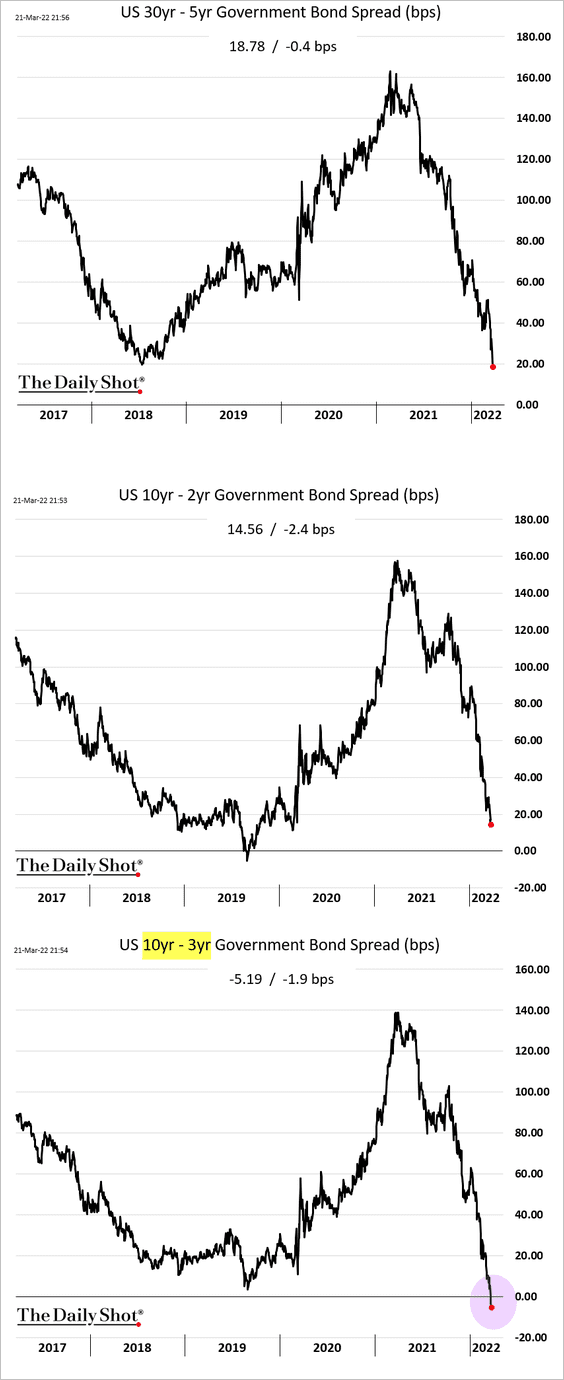

Meanwhile, the Treasury curve is nearing inversion, with the 10yr – 3yr spread already in negative territory.

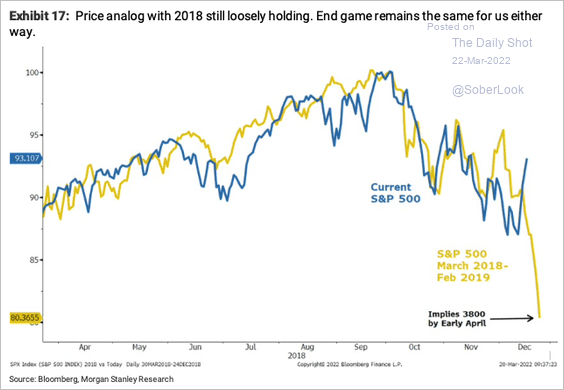

Equities: Stocks have been resilient in the face of an increasingly hawkish Federal Reserve. But, if we follow the 2018-19 trend, there lies more downside ahead.

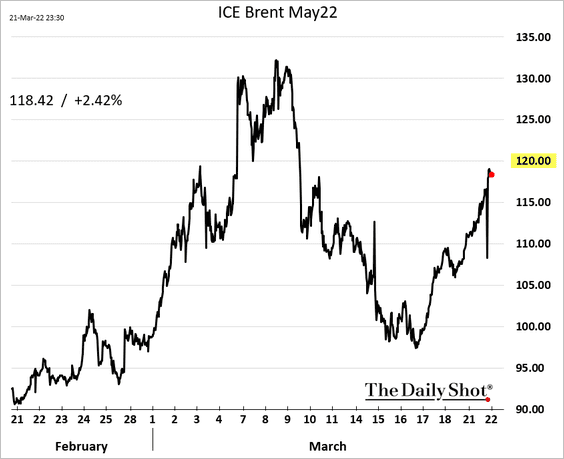

Energy: After dropping from its high of ~$134/bbl in early March, Brent crude is gunning for $120/bbl again.

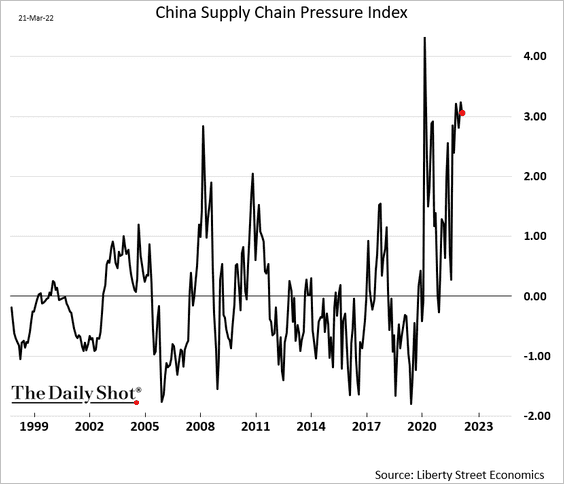

China: The China Supply Chain Pressure Index suggests that supply stresses remain elevated. This comes as recent Covid-driven shutdowns threaten to further disrupt global supply chains.

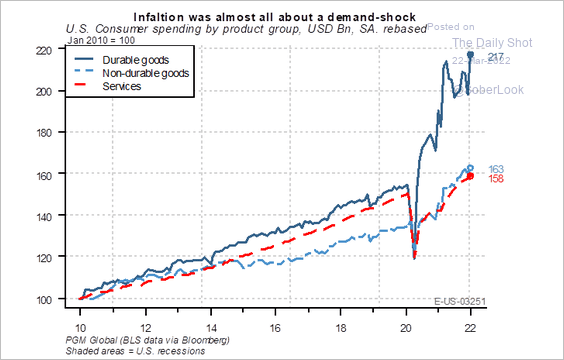

The United States: One way to ease supply issues (and therefore inflation) is by slowing consumer demand. Will the Fed’s aggressive rate hikes accomplish this without forcing the economy into recession?

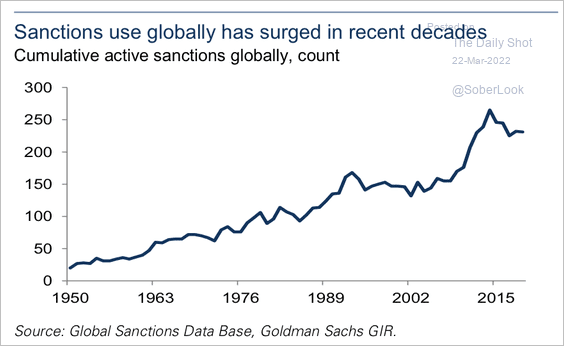

Food for Thought: Lastly, let’s look at global sanctions usage in recent decades.

Edited by William Villacis

Contact the Daily Shot Editor: Brief@DailyShotResearch.com