Greetings,

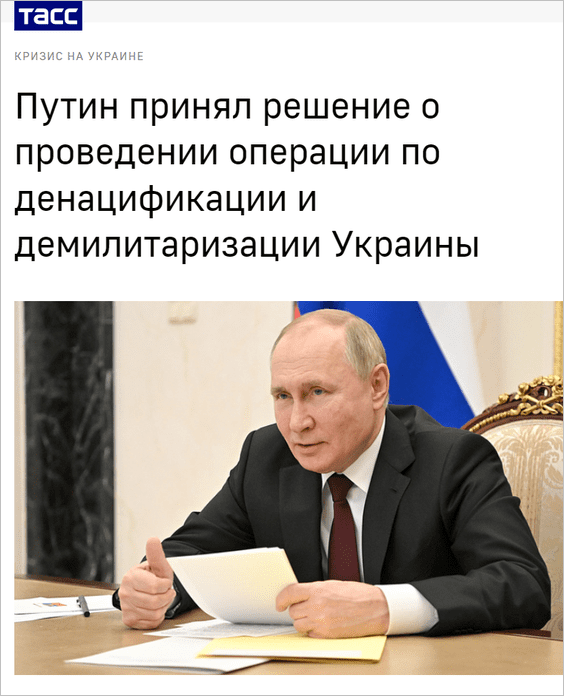

Global Developments: According to the Russian government’s news agency, TASS, …

Putin decided to conduct an operation to denazify and demilitarize Ukraine. …Russia will not allow Ukraine to have nuclear weapons.

The term “denazify” suggests that Putin intends to remove the Ukrainian government by force, which means a full-scale invasion (the Kremlin has been labeling the Ukrainian government “Nazis” for years to justify incursions).

The attacks have started.

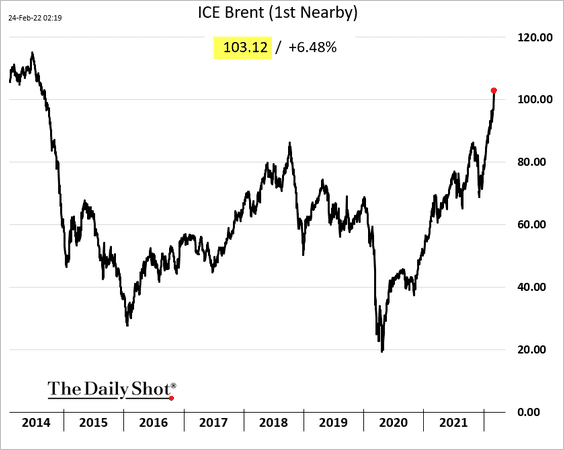

The markets were taken by surprise, with many hoping that Russia’s incursion would be limited. Brent crude oil blasted past $100/bbl.

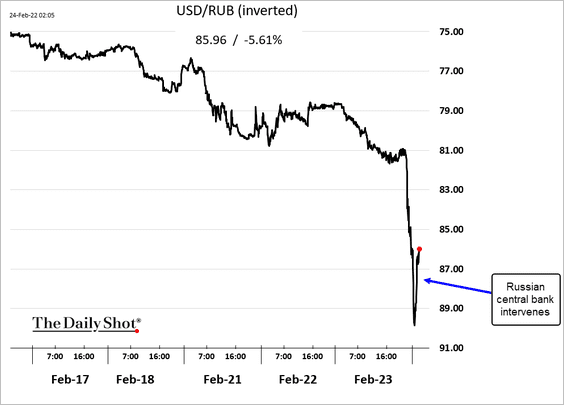

Emerging Markets: Russia’s central bank is trying to stabilize the ruble (Russia has massive FX reserves).

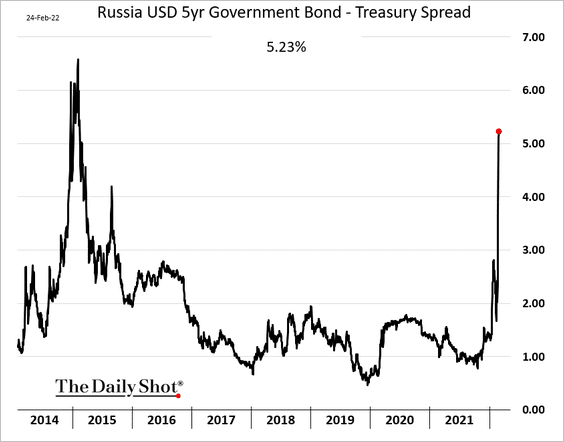

Russian USD bond spreads have exploded. Russia is likely to be shut out of the Eurobond market.

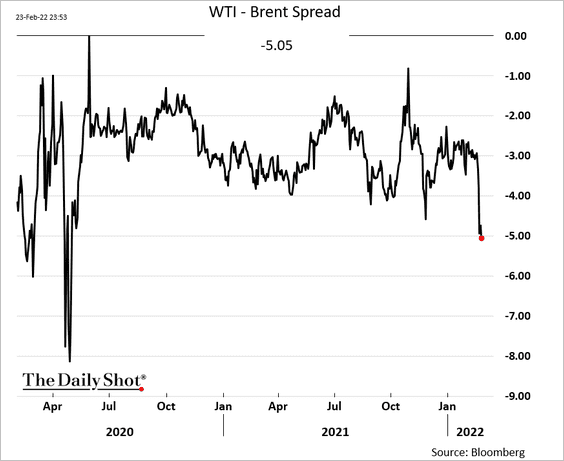

Energy: The WTI-Brent spread has widened most since US crude prices went negative during the COVID selloff.

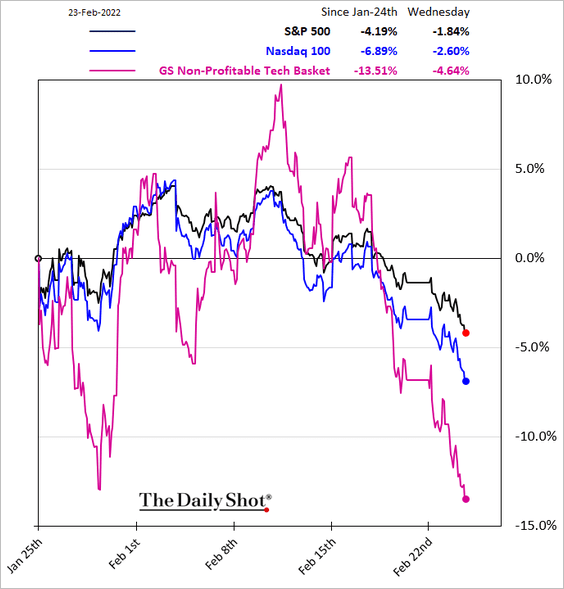

Equities: All of a sudden, corporate profits matter. Unprofitable growth companies have sharply widened their underperformance on Wednesday.

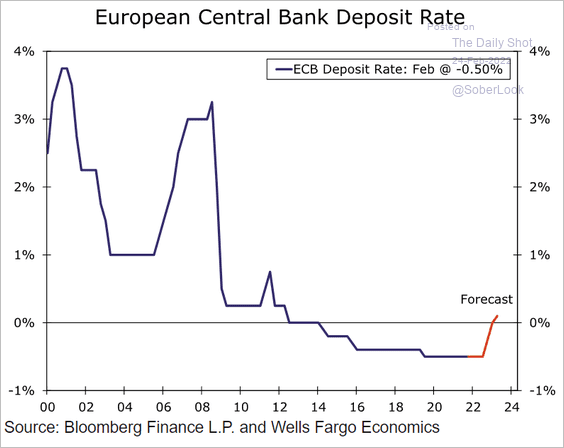

Eurozone: The ECB is expected to hike rates this year. Will the Ukraine situation delay the process?

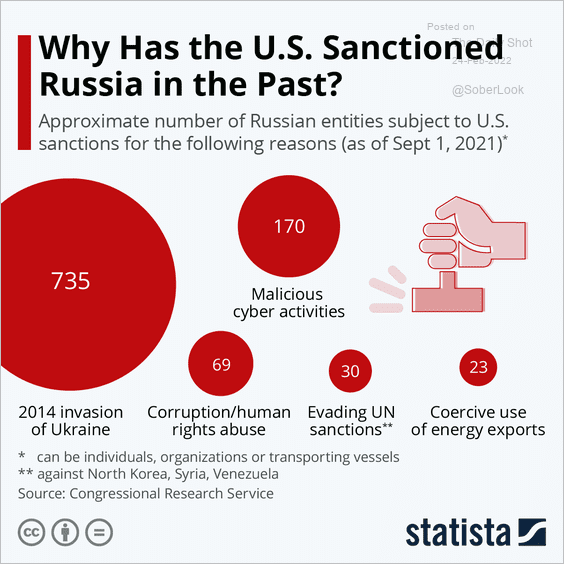

Food for Thought: Previous US sanctions on Russia:

Edited by Daniel Moskovits

Contact the Daily Shot Editor: Editor@DailyShotLetter.com