Greetings,

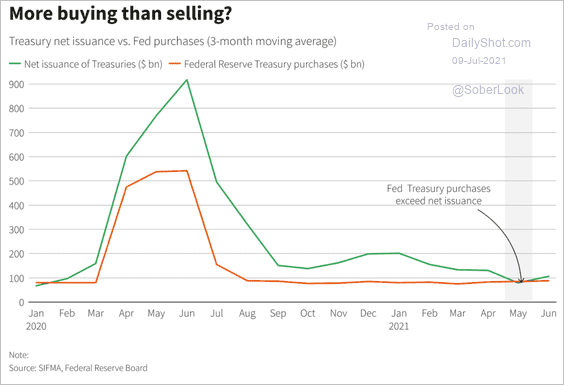

Rates: The US Treasury has been issuing less debt as it taps its cash holdings. The Fed has been mopping up all the new issuance, tightening the supply and sending yields lower.

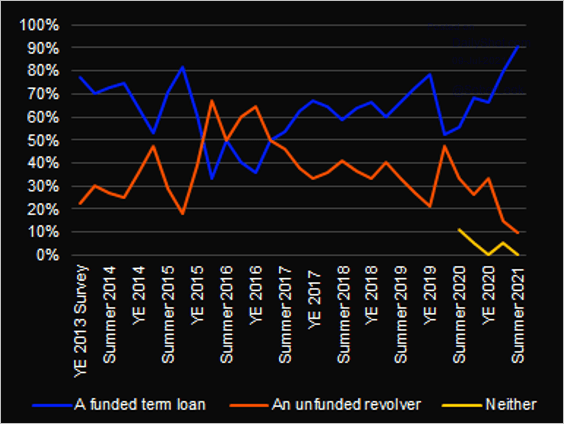

Credit: The pandemic caused companies to tap their revolving facilities (as revenues dried up), resulting in more funded exposure than banks (and other credit providers) expected. Lenders now just want term loans.

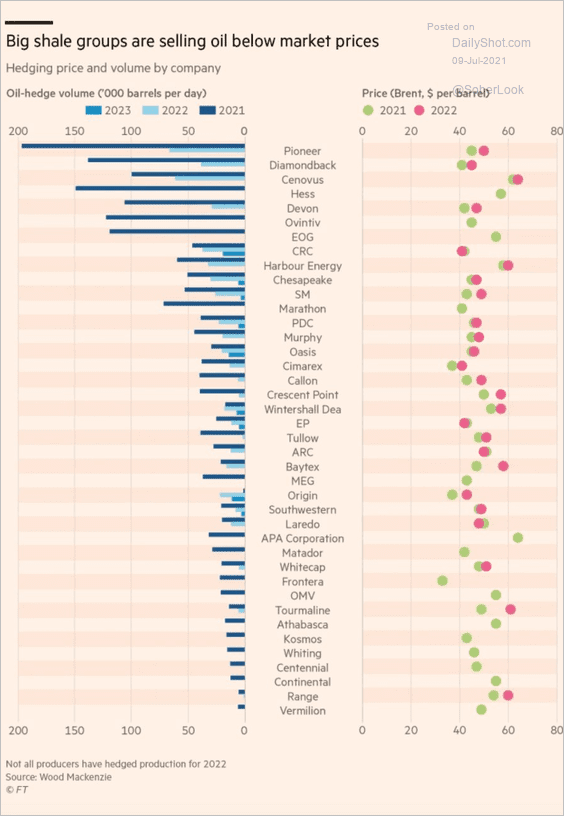

Energy: Many shale firms hedged their output and are now selling crude oil well below spot prices (hedges offsetting price gains).

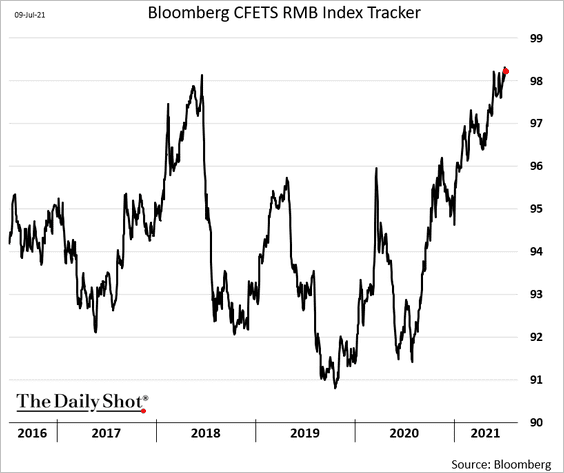

China: With consumer inflation under control and business activity moderating, the PBoC is considering some targeted easing. The central bank may cut reserve requirements for some banks.

The renminbi’s strength relative to a basket of currencies could also be making the PBoC uneasy.

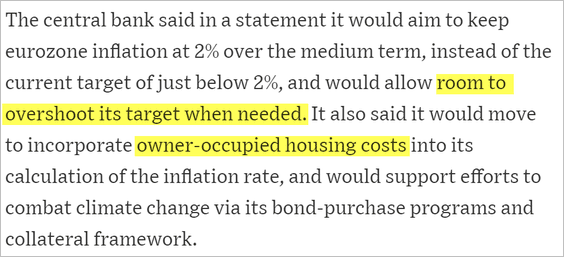

Eurozone: The ECB tweaked its policy approach after an extensive review. Here is a summary.

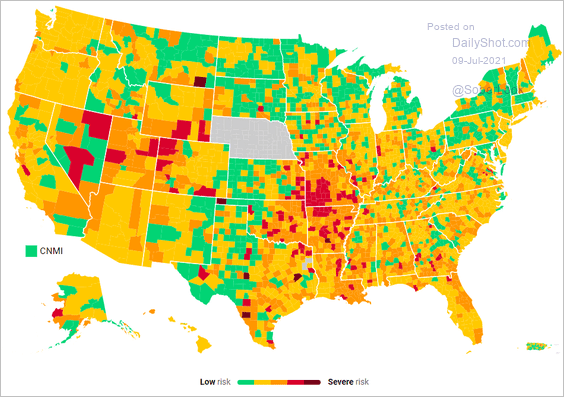

Food for Thought: COVID risk by county:

Edited by Richard Holmes

Contact the Daily Shot Editor: Editor@DailyShotLetter.com