Greetings,

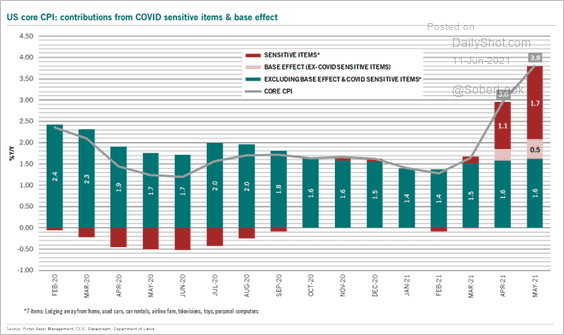

United States: On a year-over-year basis, the core CPI climbed by most in years. However, without the COVID-sensitive items (including the auto manufacturing disruptions) and the base effect, the core inflation remains relatively stable. As far as the markets are concerned, this supports the Fed’s “transient” inflation narrative.

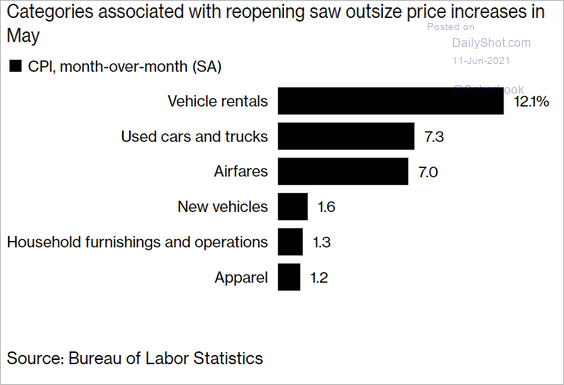

Here are the “COVID-sensitive” items.

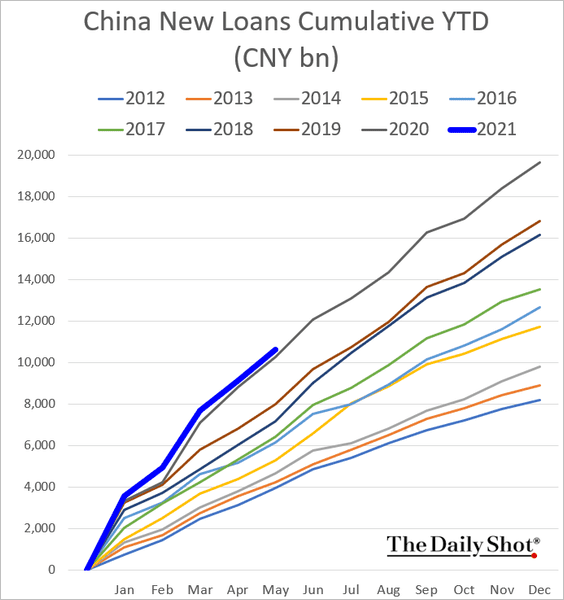

China: Domestic bank lending is hugging last year’s trend.

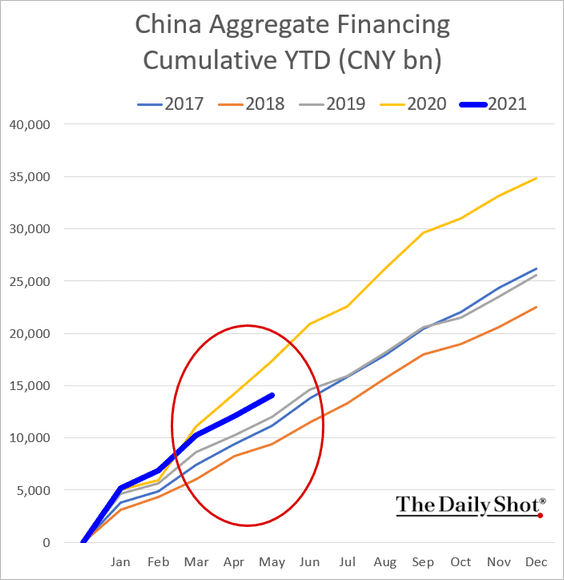

But aggregate credit has diverged sharply from 2020.

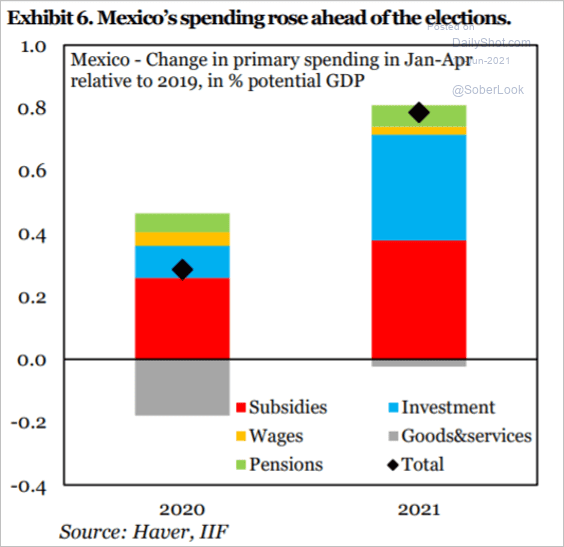

Emerging Markets: Mexican government spending rose ahead of the elections.

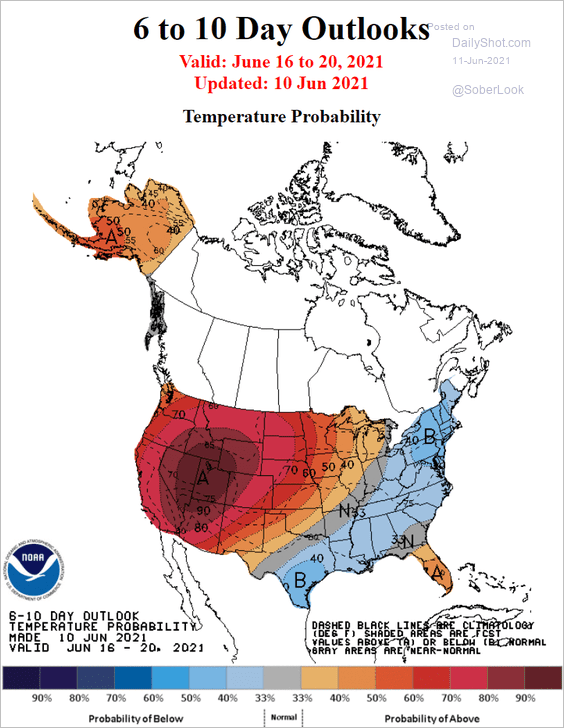

Energy: Rising temperatures and the ongoing drought sent the Hoover Dam Reservoir to its lowest level since 1937.

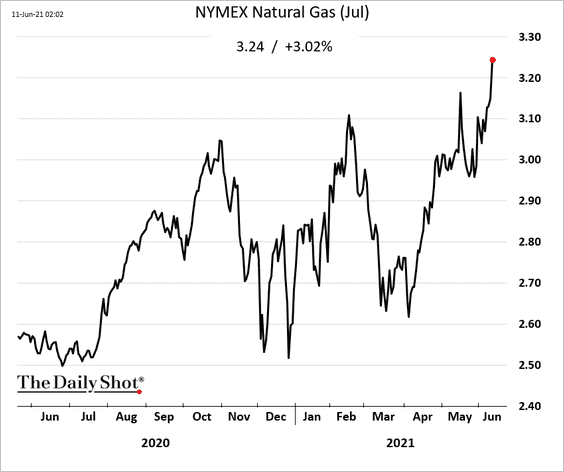

US natural gas futures spiked.

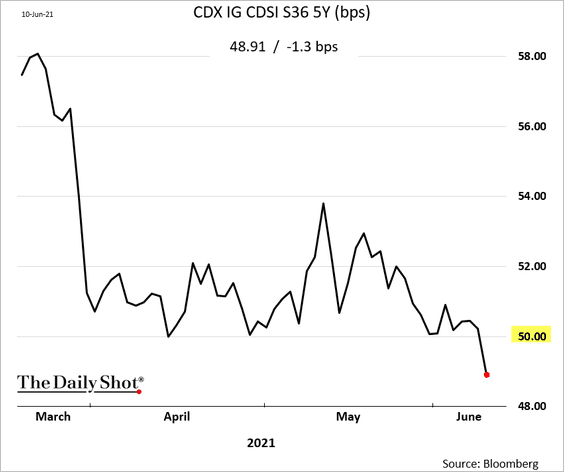

Credit: Looking for a cheap macro hedge? The on-the-run investment-grade CDX dipped below 50 bps after the CPI report.

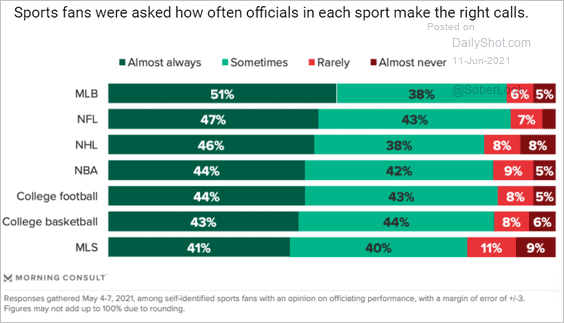

Food for Thought: Referees making the right calls:

Edited by Richard Holmes

Contact the Daily Shot Editor: Editor@DailyShotLetter.com